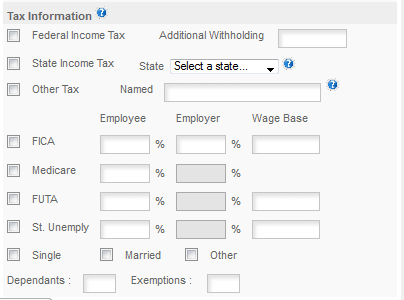

PAYROLL SETUP - TAXES: The program will determine whether to print a W2 or a 1099 at the end of the year based on the tax status of the driver. The program uses the Medicare deduction to determine the drivers status. A driver can be both a Driver and an Owner/Operator or independent contractor in the same year, but not at the same time. If the driver is an Owner/Operator or a contract driver leave the tax boxes blank. PLEASE REFER TO WHO'S AN EMPLOYEE in the Articles section of this manual before deciding to treat company drivers (anyone who drives a truck which you own) as contractors.

If the employee is an Owner/Operator who is running under your authority skip the tax section as you are not responsible for withholding or paying taxes on leased owner/operators. A 1099 will be provided at the end of the year for this type of employee.

If the employee is a company driver, office employee or other support staff start by checking the Federal Income Tax box.

ALL THE FEDERAL RATE INFORMATION CAN BE FOUND IN CIRCULAR E available on the IRS web site.

ADDITIONAL WITHHOLDING: If the driver wishes to have additional money withheld for taxes enter the amount here.

STATE INCOME TAX: Check this box and select the state from the drop down box for US states. We do not currently support taxes for other countries. There are special rules for some states which will be detailed in a popup that will appear when you select the state. WRITE THESE DOWN when the popup appears so you can be sure to follow the special setup rules detailed in the popup. This will apply mainly to how dependants or other special exemptions are handled.

OTHER TAX: If you have another tax which is not covered under the state taxes (a note when you select the state will tell you if a county or other similar tax is handled as part of the state tax setup). You will need to create a table for that tax. Creating a table for this Other Tax is covered in detail in the tutor.

FICA: Enter the employer's and the employee's contributions for FICA.

NOTE: you are entering a PERCENTAGE so for 4.2% you enter 4.2, not .042. This is the same anywhere in the program where you see a % sign next to the box.

Since the inception of the split rate for 2011 the program will continue to use a split rate for FICA witholding so be sure to enter BOTH FIELDS. THE EMPLOYEE/EMPLOYER labels only apply to the FICA boxes. All the rates below that (in the Employee column) are shared rates or apply to driver or company as required. This seems a little confusing to some users, so just remember the FUTA and STATE UNEMPLOYMENT apply to the company not the driver. Drivers to not pay the Unemployment tax, it's the company's responsiblity.

So for FICA you will also need to enter the rate in the employee & the employer boxes even if they are the same.

The wage base is the ceiling for FICA withholding. The program will not withhold for FICA if an employee's earnings exceed the amount you enter here. You can find the Wage Base in IRS Circular E or get it from your tax advisor. DO NOT ENTER ZERO - that will stop the program from withholding FICA and it will be your responsibility to pay it for the driver.

FUTA: Federal Unemployment tax is next so check the FUTA box.

NOTE: Unemployment tax is not deducted from the employee, but payroll needs to know the percentage so that it can expense the employer expense for both federal and state unemployment when payroll is run.

ST UNEMPLY: State Unemployment tax. You will need to get the rate for this from your state unemployment office. They should have send you an letter with the current rate. This rate is subject to change so be sure to update it when necessary.

EMPLOYEE STATUS: Enter the status for the employee, single, married or other which is used for Head of Household.

NOTE: Some states will have special exemption rules and/or special STATUS rules. If your state has special rules a popup will appear when you select the state - WRITE THESE DOWN so you can apply them correctly. If you do not follow those special instructions the state withholding will not be calculated correctly.

DEPENDANTS: Enter the number of dependants from the employee's W4. This field is always used for calculating the federal withholding.

EXEMPTIONS: This field is used by certain states where special dependant or exemption rules are used. These rules will be in the popup that appears when you select the state - WRITE THESE DOWN so you can apply them correctly. If you do not follow those special instructions the state withholding will not be calculated correctly. Yes this is redundant by design.

SAVE: click Save to save the record.

NOTE: If you change the rates and then go back and clear a previous week and recalculate it it will use the new rates you now have entered, not the previous rate!! So if you are clearing a previous payroll and then rerunning it be sure that the rates set for the employee are correct for the date of that payroll.

NEED HELP SETTING UP PAYROLL??

Remote one on one assistance is available for $25/15 minutes or portion thereof. If you need more in depth assistance contact us for details on our On Site Consulting & Training.