Please refer to the Understanding

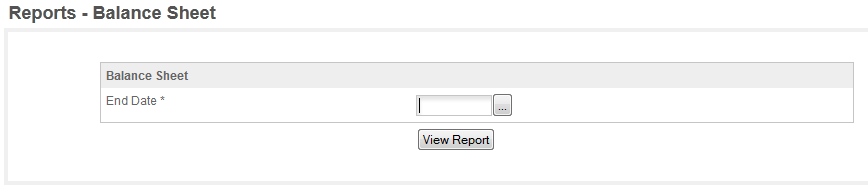

Balance Sheet vs Profit & Loss for a discussion on what the Balance Sheet is and how it works. The report is available for any date and will run from the first entry in the program through that date -

Once you select the ending date your have an option to use either a Calendar Year or a Fiscal Year report. If you use the Calendar year for your taxes click YES if you or select NO for a Fiscal Year. See the Note at the bottom of the box. The P&L information is part of this report so you will want to generate a P&L for the same period used by the program for the Balance Sheet if you want them to agree.

Once you select the time period the report will print. The sample report is long and requires a full page. The explanation in the next 2 pages, the report is on the following page. To simplify understanding the Balance Sheet you might want to print out that page and then use it for reference as you go over the following information about the report.

ASSETS - Your current assets -

CASH ACCOUNTS - Cash, Checking & Saving are all listed under this heading.

OTHER ASSETS - Trucks, Property, Buildings, and similar items are listed here.

RECEIVABLES - You current outstanding receivables are listed here.

LIABILITIES -

CURRENT LIABILITIES - this is your charge accounts, credit cards, Driver Reimburse, etc are considered Current Liabilities.

OTHER LIABILITIES - truck and other long term loans are considered Other Liabilities. If you are using Payroll liability accounts that you set up for use in payroll are also listed here. In our example Truck Insurance would be in this category.

NET WORTH - Net Worth is your Assets - Liabilities. Technically this is the end of the Balance Sheet. The items below are sometimes included and sometimes not. For our Balance Sheet they will always appear at the bottom of the sheet.

OTHER ITEMS AT THE BOTTOM OF THE SHEET - these items are set up for a Pass Through type of entity which covers most of our current users.

OWNER DEPOSIT: this will be the total of all deposits made by the owner.

OWNER DRAW: this is the total draws taken by the owner.

OWNER EQUITY: this is the owners equity in the company.

OWNER EQUITY JE: this is an example of setting up individual Owner Equity accounts.

P/L TOTAL: this is the P&L total for the Current or Fiscal Year selected.

CURRENT EQUITY - this is a heading for the current equity entries below. There are for the current YTD or Fiscal Year.

BEGIN BALANCE: this is the beginning balance for the Owner Equity Account

+ RETAINED: plus retained earnings are from the P&L from start of your books to the start of the P/L Total above.

+ PROFIT/LOSS: plus the P/L total from above (current P/L total)

-DRAWS + DEPOSITS: minus Draws and Plus Deposits

NEW BALANCE: this is the Balance given by doing the math in the 'Other Items sections.