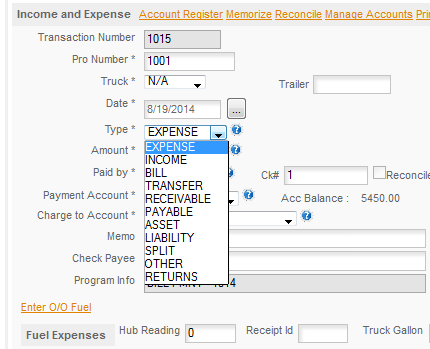

UNDERSTANDING THE TRANSACTION TYPES -

Expense:

This one is relatively simple this is basically anything that you purchase for use on, in or around your truck. It also includes meals, showers, laundry when you're away from home etc.

WHAT IT DOESN'T INLCUDE - there is often a misunderstanding about things like your Truck Payment or other payments on Assets the company may own. When you make a payment on an asset, such as your truck payment, the interest portion of the payment is an expense but the principal is not. The principal reduces the liability you have on the truck or other asset but it is not a direct expense. The truck is expensed through Depreciation rather than by expensing the payment. Quite often the truck is depreciated much faster than the payments. This has the advantage of giving you a bigger tax deduction for the truck for the years where it's value is high. It has the disadvantage of not giving you a deduction for the principal payments after the truck is fully depreciated. You should discuss this with your accountant to be sure you understand the way he is depreciating the truck and the advantages and disadvantages of doing it different ways.

Income:

Again this is a fairly straight forward amount. It's any payments you receive for services performed using your truck. If you are an Owner Operator leased on it represents the money you are paid by the company you are leased to and you'll get a 1099 from the company for the amount they paid you. For the Company Driver it represents your pay and you'll get a W2 from the company. If you run your own authority or if you are a fleet the program tracks your income as your Receivables. Since payment is generally not received for weeks and sometimes months using the Receivables to track revenue gives you a much more accurate picture of how you are doing as the Income is generated at the same time that the expenses to earn that revenue are entered into the program.

Bill:

Bill is used to enter something that you need to pay in the future. For example if you Broker a load the program will create a bill for the load to pay the contractor in whatever number of days you specify in the contract. For your bills you can enter them when they come and the program will then remind you when to pay them. Just remember the program reminder comes up on the date you enter so don't enter the due date from the bill you need to allow time for mail if you're sending a check. You can also just enter the bills as an expense when you pay them if you don't need the program reminding you.

Transfer:

Transfer is used to move money from one account to another and for Owner Draw and Owner Deposit entries. To move money from one account to another you will have two entries for a transfer. For example to transfer $100 from My Checking to the Cash account you would have -

ENTRY 1 ENTRY 2

TYPE; TRANSFER TRANSFERS

AMOUNT: -100 100

PAID BY: CHECK N/A

PAYMENT ACCOUNT: MY CHECKING CASH

CHARGE TO ACCT: TRANSFERS TRANSFERS

We suggest using Quick Entry for transfers as it will give you a popup with the FROM & TO accounts and will do both entries for you automatically. For owner draws and deposits use the Quick Entry/Equity Accounts section.

When a transfer is used for Owner Draw or and Owner Deposit the program has special code to handle this type of transaction as a single entry so you do not need two entries for it. For example, to enter an Owner Draw for $1000 you would have -

OWNER DRAW OWNER DEPOSIT

TYPE: TRANSFER TRANSFER

AMOUNT: -1000 1000

PAID BY: CHECK N/A

PAYMENT ACCT MY CHECKING MY CHECKING

CHARGE TO ACCT: OWNER DRAW OWNER DEPOSIT

Receivable:

Receivable is used for things that are due to you. For example if you run your own authority and use the billing and invoice functionality your invoices are TYPE: Receivable and the CHARGE TO ACCOUNT is Receivable. Receivables if you're not familiar with the term are your outstanding invoices. Outstanding means the ones that have not yet been paid. If you are a company driver, your Driver Reimburse expenses are Receivables, TYPE: Receivable, CHARGE TO ACCOUNT is Reimbursed Expense. Reimbursed Expenses do not count as income and so go into a separate category when they show up on your settlement.

An extremely common RECEIVABLE question is how to enter the payment when it's received and there are fees or deductions from the payment. This is covered in the

Accounts Receivable in the

Entering A Payment topic.

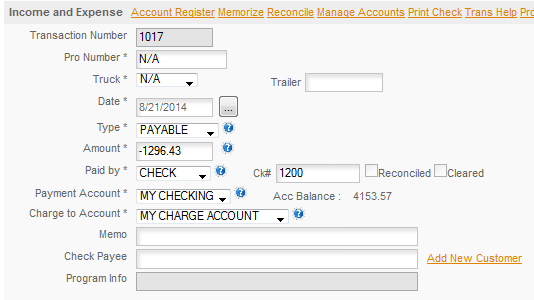

Payable:

Payable is a special account type that is only used for opening or entering payments on a credit card or charge account.

This is sometimes confusing to some of our users who have a background in accounting or bookkeeping. Yes, all bills are payables, but in Truckers Helper we treat all bills as expenses and only use the Payable type when you are making a payment on a charge account or credit card. The payable type let's the program know that this is a payment on a credit account and you use the account you are making the payment on as the CHARGE TO ACCOUNT. So a payment on a credit card would look like this -

This payment would represent a payment in full with NO INTEREST. If you are making payments and there is interest charged on the account then you would use a split entry. Refer to the

Quick Entry - Payment On A Charge Account for an example of this entry.

Charge Accounts Expense the items you purchase using them at the time of the purchase, not when the payment is made on the account. This means that the expense will show up on your reports when you purchase the item. A charge account is a current liability so the payments on it are shown on your Balance Sheet, not as expenses on your Profit & Loss statement.

Asset:

An asset is something that you own that generally has a value over $500 or $1000. Talk to your accountant to find out where he wants to draw the line on what is an asset and what is just general operating expenses. As an example if you purchase a CB radio for your truck for $450 that would probably just be an expense. If you purchase a new set of tires for $4000 that would generally be an Asset. The difference is that an expense is not reported separately on your taxes and is not depreciated. You simply deduct the amount you spend as an expense. An asset on the other hand is something that generally lasts for several years, represents a considerable investment and is depreciated over it's expected lifetime rather then expensed when you purchase it. This category is used when you purchase or sell and Asset. For examples of these transactions see Quick Entry - Assets.

Liability:

A liability is money that you owe. All things you owe are liabilities and they are sorted into two categories, Current Liabilities which include things such as Credit Cards and Charge Accounts that you have an open account with. While day to day operating expenses, such as the power bill, rent, etc. are also liabilities in a sense they are not generally considered as liabilities for reporting purposes. These are generally reported on the Profit and Loss statement as expenses. Long Term Liabilities are generally fixed loans that you have scheduled payments for. For example your truck loan would be a long term liability. If you owned a facility and had a loan on it that would be considered a long term liability.

So short term liabilities are generally open account type things such as a charge account or credit card. Long term liabilities are generally fixed loans for large purchases.

Payments on Liabilities are generally split entries as you will have an Interest portion of the payment and a Principal portion. The principal portion is applied to your balance and reduces the balance you owe, the interest portion is an expense. Refer to the

Payment On A Charge Account topic referred to above for an example of this type of entry. You can also use the Quick Entry to open a Liability account - Quick Entry Open Accounts - Liability, or to make payments on a Liability - Quick Entry - Liability.

Split:

A split entry occurs when you need to divide a single transaction into different categories. For example a loan payment where you have both Principal and Interest, a Receivable where you have the payment and they deducted charges and fees. Another example would be an entry where you purchased several different things with a single purchase. For example you stop for fuel and get a tail light and some oil for the truck and want to enter it all as a single transaction. For examples see the Split Entry topic.

Other:

The program will use other on some occasions for open account entries and it may rarely be used in making an adjustment, but overall this is a TYPE that should be avoided as reporting will not know how to handle transactions that have Other for a type.

Returns:

This is a special type that has been added to handle returns. You can enter the item using the original CHARGE TO ACCOUNT and the original Payment Account so that the money is put back into the account it came out of and the expense is backed out of the expense account it was charged to originally. See

Quick Entry - Income/Refunds for details and an example of how this works.