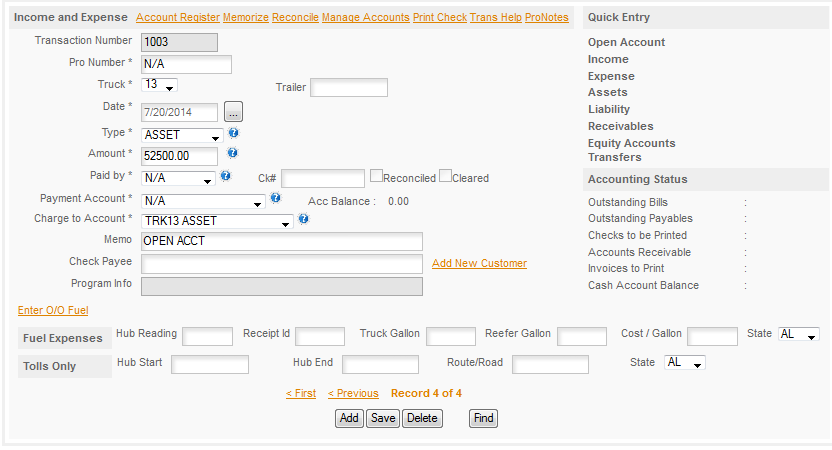

UNDERSTANDING THE INCOME & EXPENSE PAGE:

We'll take a look here at the main entry portion of this page and talk about what goes here with enough 'why' to help you understand the page. We'll then break the other sections of the program into separate categories and go over them one at a time.

DATA ENTRY SECTION: This section is the left side of the page.

Transaction Number:

This is a program field. ALL GRAYED OUT FIELDS are program fields and cannot be edited. The transaction number is used by the program to keep track of things.

Pro Number:

The Pro Number is defined in detail in the Glossary so we won't repeat the long meaning here. Suffice it to say this is the number that you will use to keep track of a load and all the income & expenses and related things that are required to track that load. In order to decide if you need to use the Pro Number or not you'll ask yourself does this item relate DIRECTLY to that trip (load). If it does then you enter the Pro Number if it doesn't you use N/A or leave it blank and the program will enter N/A for you.

EXAMPLES: A lumper relates directly to the trip, the gloves you bought to use unloading the trailer do not as you will go on using them for other trips. FUEL does not relate to the trip as fuel is used for all trips and you do not replace the used fuel every trip. Tolls on the other hand relate directly to the trip you are on when you incur the toll.

Truck:

Basically the same rule applies here that you use for the Pro Number test. If the income or expense related DIRECTLY to the truck, then you enter the truck number. Tractor Fuel for example always relates to the truck, so gets the truck number. Refer Fuel does not relate to the truck and so would get N/A for the truck number and a Trailer Number would be used instead. Trailer number is to the right of the Truck# and does not have a drop down. The program requires that you enter your truck number in Truck Maintenance in order to use the number. Since it works for both the Fleet and the One Truck and company drivers haul a variety of trailers the program doesn't require tracking trailer numbers.

Date:

Enter the date of the transaction that you are entering. This is generally the date on the receipt. It is not necessary to enter the year if the entry is in the current year, the program will enter the year for you. The date format is - MM/DD/YYYY where M is month, D is day and Y is year.

Type:

This is the type of transaction you are entering. The types available are: Expense, Income, Bill, Transfer, Receivable, Payable, Asset, Liability, Split, Other, Returns. These are all described in detail in the

Transaction Types section so please refer to that section for a full explanation of each type. Amount:

This is the amount of the transaction you are entering. The program uses negative numbers where appropriate and does not hide these. DO NOT CHANGE THE SIGNS OF NUMBERS, doing so can cause errors in your accounting. We have audits to catch and stop you from changing them in some situations but not in EVERY situation, so let the program decide on the right sign to use and leave what the program sets the way it was originally entered.

Paid By:

This is how you paid for something. The options are CASH, CHECK, SAVINGS, TRANSFER, LIABILITY, N/A. If the item was not paid, INCOME for example then N/A is used as that is not paid. This topic is also covered in greater detail in the

Paid By topic.

Payment Account:

This is the account you paid this from. The accounts listed here will be cash and charge accounts that you use to pay for things. It is permissible to use a personal credit card for business expenses, but it's preferable to have a dedicated business credit card to use for all your business expenses. Cash accounts are any account that is cash in nature. For example checking and savings accounts are considered 'cash accounts'.

Check Number:

The program will keep track of the last check used and load the next check number automatically. If you lost or destroyed a check you can edit the check number here.

CHECK NUMBER 1 is a reserved number and is used for all electronic type transactions. ATM, BILL PAY, etc.

Charge To Account:

This is the account that keeps track of what the item you have entered was for. For example there's a Charge To Account for Fuel - Truck which you use when you purchase fuel for the truck. Again this is too large a subject for this overview page and details can be found under the

Charge To Accounts topic.

Check Payee:

This is where you will keep track of who you paid. You can have as many entries as you want in the Address Book, but generally people find it easier to use overall categories for some purchases. For example you could use Truck Stop as a general check payee for meals, fuel, and other items that you generally pick up at a truck stop or you could enter each truck stop individually in the Address Book and track expenses by individual truck stops if you wanted (but it does add a lot of extra work to the process).

Program Info:

This is another section that is used by the program to keep track of background information that the program uses for tracking, finding and sorting data. This field cannot be edited.

Enter O/O Fuel:

This is a special Function for use by fleets who have Owner/Operators who purchase and pay for their own fuel but the company is tracking and paying the IFTA taxes for them. It creates a zero I&E entry to go with the fuel entered under Fuel Expense. It is a quicker way to make this entry as compared to adding the I&E entry manually.

Fuel Expense:

This is where you will enter fuel purchases to keep track of your gallons and state purchased for IFTA reporting. For the One Truck this will generally be used with FUEL - TRUCK or FUEL - REFER Charge To Accounts. For the fleets it may be used with those accounts or for Owner/Operators or others who pay for their own fuel and use a company fuel card it may also be used with Driver Advanced. The IFTA reports will gather information from this field regardless of what Charge To Account is associated with the entry.

Tolls Only:

This is used to track tolls and toll miles for those states where it matters for IFTA reporting.

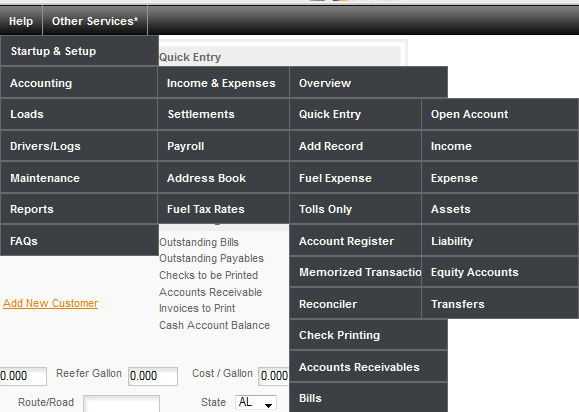

QUICK ENTRY SECTION - this will be handled in a separate topic as it's too large a topic to include here.

INCOME & EXPENSES FUNCTIONS - this is also covered in a separate topic for each function.

For additional help with the data types and information that goes in the various fields described above click the Quick Tip Icon

next to each field.

For help with making an entry see the QUICK ENTRY & MANUAL ENTRY topics. The HELP section in the program also offers an extensive array of Tutors to help you with most of the common topics and questions we have received over the years.