Sale Of An Asset

Ok, so let's say you own a truck and you have a book value of 17037.04

Asset $67000

Accumulated Depreciation $49962.96

Loan on the truck with a balance of 12276.43

You sell the truck for $40000. So you net 40000 - 12276.43 = 27723.57. That will be the amount of the deposit.

So you have a net gain of 27723.57 - 17037.04 = 10686.53 which is a capital gain on the sale of the truck. This is what's left from the sale price after you pay off the loan minus the book value of the truck.

There is no 'quick and easy' way to do the sale of an asset all in one transaction. So this will detail the transactions that are required. You can do part of it, the Capital Gain and the Liability in one split transaction. But the transfer of the ASSET value and the transfer of the Depreciation from the Accumulated Depreciation account all need to be handled separately. We'll deal with all the transactions in this section.

This, by the way is a time when it's very handy to have a Balance Sheet. The adjustments we're making affect an asset and other balance sheet accounts, so being able to run a balance sheet before and after will be very useful in being sure that the entries are all correct.

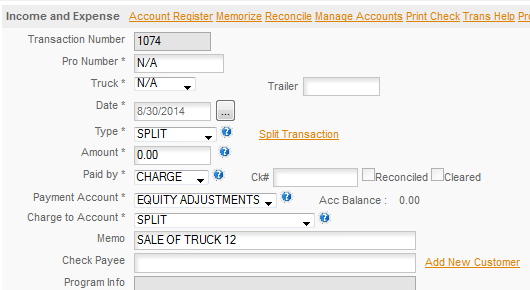

The first thing you need to do is take the depreciation off the value of the Asset. To do this you will use an EQUITY ADJUSTMENT, this transaction is just a shift of paper values. So we'll use a Equity Adjustment transaction and transfer the value from the asset to depreciation. If you do not have an Equity Adjustment account yet, it's not a default account, open it as a charge Account. Quick Entry/Open Account/Charge. Another account you'll need to transfer funds around is SALE OF ASSET, open this as an Charge To Account with the TYPE as Income.

Note: Equity Adjustments are ALWAYS for zero. This account is not meant to have a balance, it should always be zero's out when you are making adjustments to your books.

The split entry will look like this -

Note: Accumulated Depreciation - I'm not sure why accountants like this, but they do. So if you have an Accumulated Depreciation account, it is a 'negative asset' account. So the entry above will work to deduct the depreciation for the truck from it and move it to the asset.

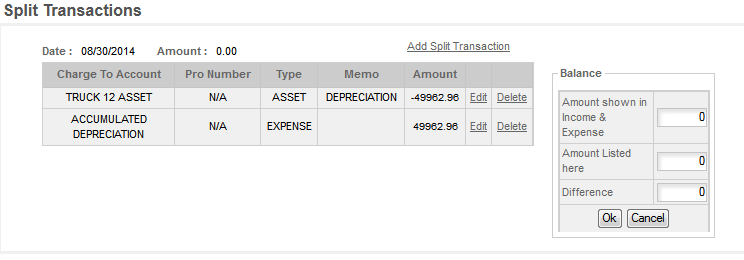

So we have expensed the $49,962.96 in depreciation and taken that value off the Asset. To double check that this entry worked correctly you can then check the Account Register -

Which shows the correct value for the asset at this point.

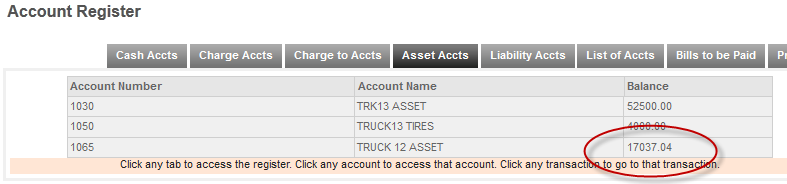

Next we'll do the actual bank transactions. For this we'll need two separate transactions, first we'll need to show the income that we're receiving and deposit that into the bank. You can combine the Capital Gain and the Loan Payoff into one transaction if you wish or you can do them separately. For our example I have combined them. If you want to do them separately, you would need to adjust the deposit amount and leave off the 3rd transaction in the split. That's the one that pays off the liability. You could then write a check to pay off the liability and do it as another transaction. The income from the sale and the Capital Gain can still be combined as is shown here.

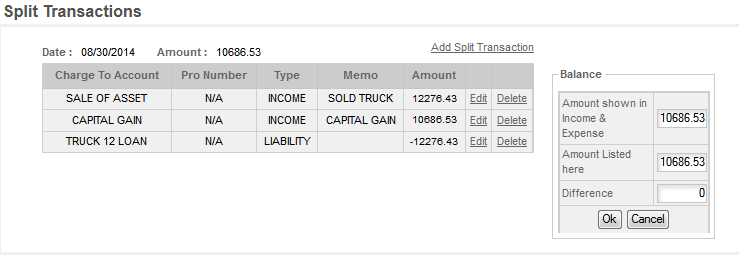

The 10686.53 is the Capital Gain. The deposit portion of the transaction is actually $22962.96, but we are also paying off the liability in this transaction so that reduces the deposit to $10686.53. If you do not want to combine the Liability Payoff in this transaction you would show the $22,962.96 as the deposit amount in the main transactions and omit the third entry below. The split is -

This brings in the Capital Gain and the amount that we used to pay the loan off under Sale Of Asset. It then Pays off Truck 12 Loan with that money.

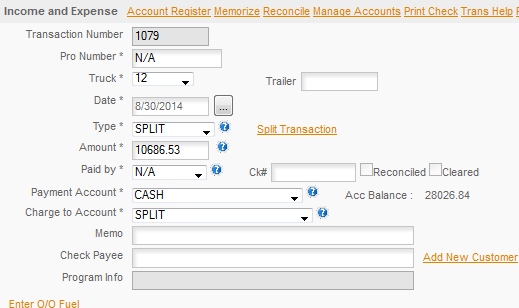

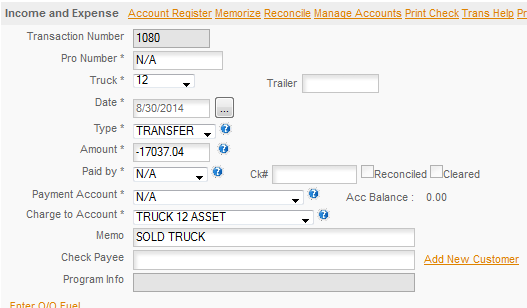

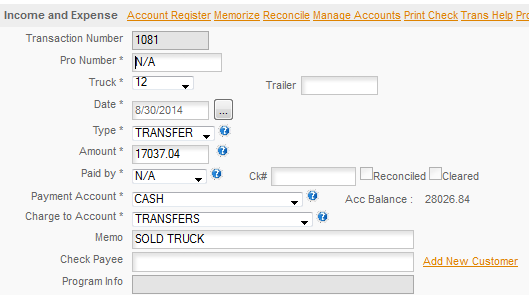

Finally we need to transfer the value of the Asset to the CASH account. In our example we used the CASH account, but you would use whatever account you are depositing the money into as your Payment account. The transfer is 2 entries -

This transfers the money FROM the asset account.

This transfers the money into the CASH account

Note: you cannot use Quick Entry to generate this transfer directly. You can use it to create the two transactions, then edit each as necessary to match the pattern above. See: Quick Entry/Transfers/Editing Transfers for an example of this.

At each step along the way I checked the Balance Sheet to be sure it was still in balance and I checked the Account Register to be sure that the Liability was cleared and the Asset was set to zero. We have now paid off the loan, set the value of the asset to zero and captured the Capital Gain on the sale.

Note: any time you sell an asset for more than the Book Value of the asset you will have a Capital Gain on the sale. Anytime you sell it for less than the Book Value you will have a Capital Loss on the sale.