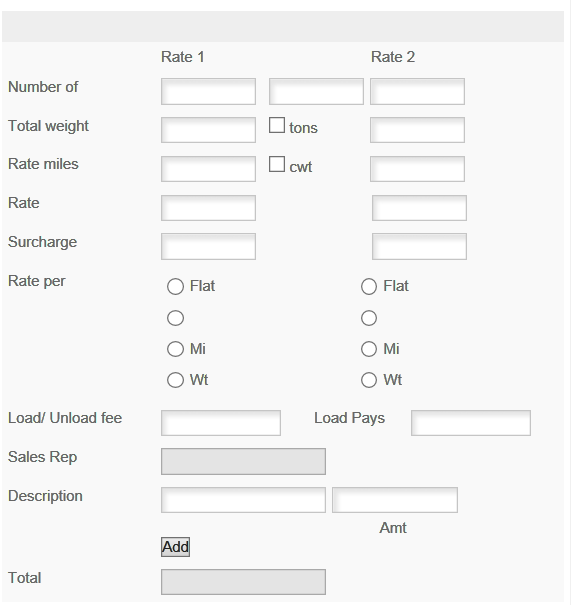

Rate Information

Here you will enter the amount that you are going to bill for this load. The billing is divided into different categories and these are used in conjunction with percentage pay which you have set up in the Payroll Setup section. Here are the fields for the rate section -

|

Number Of

|

Enter a number of items. Descriptor for items goes in the center box.

|

|

Descriptor

|

Quantity designator for Number Of. PCS, GAL, PLT, etc. Any 3 letter word or abbreviation can be used.

|

|

Total Weight

|

Enter the total weight for the load. Check the TONS or CWT for tons or CWT as the designator rather than LBS.

|

|

Rate Miles

|

Enter the number of RATE MILES* (see below)

|

|

Rate

|

Enter the rate. This will be multiplied times the quantity above depending on the Rate Per chosen.

|

|

Surcharge

|

Enter the surcharge amount or a % for the program to calculate the surcharge based on the Rate Per chosen.

|

|

Rate per FLAT

|

The amount entered in the RATE box is chosen as entered.

|

|

Rate per Descriptor

|

The descriptor that is entered in the Descriptor box will appear here. The Number Of will be multiplied times the rate to get the amount to bill for the basic rate.

|

|

Rate per Mi

|

This is the number of miles to bill for. Miles will be multiplied by the Rate to get bill amount.

|

|

Rate per Wt

|

This is the weight to bill for. Total Weight will be multiplied by the Rate to get the bill amount

|

|

RATE 2

|

If you are billing a split rate you can use column 2 for the second rate. This is also used by Payroll Setup if you pay different rates for Empty and Loaded Rate Miles.

|

|

Load/Unload Fee

|

This is the amount that will be billed for loading and/or unloading

|

|

Load Pays

|

This is used to specify an amount to pay the driver/truck for the load. See Payroll Setup for details.

|

|

Sales Rep

|

Used to designate a Sales Representative to pay for this load. See Payroll Setup for additional details.

|

|

Description

|

This is used for entering Other Amounts - this is the description of the item.

|

|

Amount

|

This is used for entering the Amount to bill for the item described above.

|

|

ADD

|

This is used to add additional items to the Other section described above.

|

|

Total

|

This is calculated by the program when you save the record and represents the total amount to be billed.

|

|

|

|

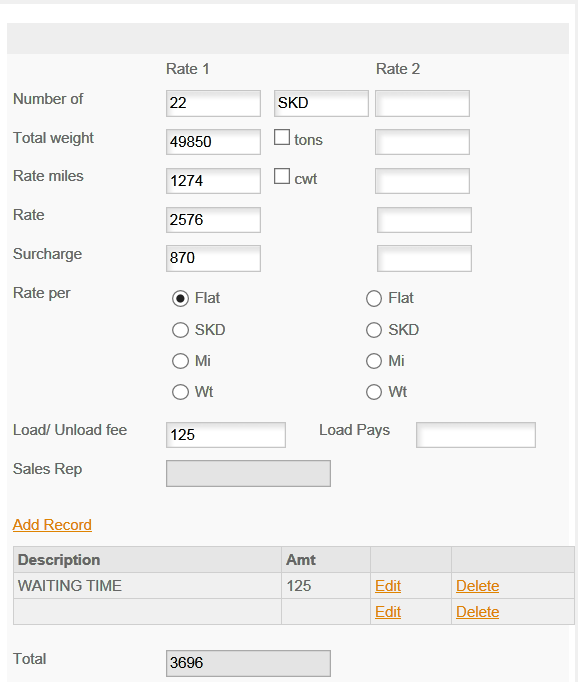

See the example below for an illustration of a filled out billing form -

HINTS & TIPS:

QUICK PAY & DISCOUNTS -

DO NOT ENTER NEGATIVE AMOUNTS IN THE OTHER PAY SECTION FOR QUICK PAY OR DISCOUNTS!! The amount shown here should be the amount billed. If you pay a Quick Pay fee or the broker or shipper takes some other discount from this amount you will enter that as an expense when you enter the payment as received for the invoice. Dealing with Discounts is covered in the Income & Expense section under Accounts Receivable.

BROKER/SHIPPER ADVANCES -

DO NOT ENTER NEGATIVE AMOUNTS IN THE OTHER PAY SECTION FOR ADVANCES!! The truck is at the shipper and the shipper gives the driver a $1000 cash fuel advance. Now what??

FIRST - let's clear up advances. There is NO SUCH THING AS A FUEL ADVANCE. Advances are payroll that you give to the driver of the truck in advance of his actual payroll check. He may spend the money for fuel, he may spend it on partying, the point is once you give it to him it is HIS MONEY. It is no longer in your control so treat it that way. Enter the advance in the Income & Expenses section as TYPE: INCOME and the CHARGE TO ACCOUNT is ADVANCED and be sure to include the Pro Number. Deposit that money in the CASH account and then give it to the driver as a Driver Advanced from the CASH account. The advance will then be reflected on the INVOICE and the balance due on the invoice reduced. It will be seen by payroll and deducted from the drivers pay. If the driver spends that money on REIMBURSED EXPENSES it is his responsibility to turn in the receipts, which you then enter into I&E as EXPENSES and the PAID BY will be DRIVER REIMBURSE. Payroll will then also reimburse him for those expenses. In this way the money is brought in, dispersed and accounted for.