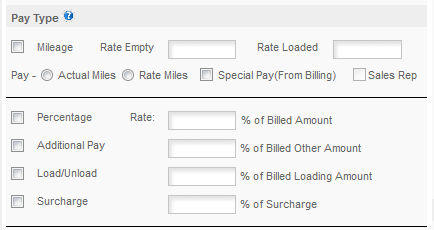

Pay Type is where you tell the program how you will pay the driver. The Options are MILEAGE PAY, pay a certain rate per mile; PERCENTAGE pay a certain percentage of the billing amounts and SALARY pay a fixed salary. At this time you can only have one pay type set up in Payroll Setup for the driver. If you pay multiple ways you will need to set up the most complex in Payroll Setup and enter the other manually when you run the payroll.

MILEAGE PAY: This can be setup to pay the same or different rates for Empty and Loaded miles. The mileage to use can be either ACTUAL MILES which will be taken from the MILEAGE section, or RATE MILES which will be taken from the BILLING section. Actual miles can be entered manually from drivers trips sheet or created by the program using the ProMiles routing engine.

SPECIAL PAY: (FROM BILLING section) is a special field that is used if you want to specify a flat amount to pay for the load. In order to use this option you must set up an alternate method of payment. The program will use this method if no Special Pay amount is specified in Billing for the current Pro Number.

Check the Special Pay box if you want to use this method of payment.

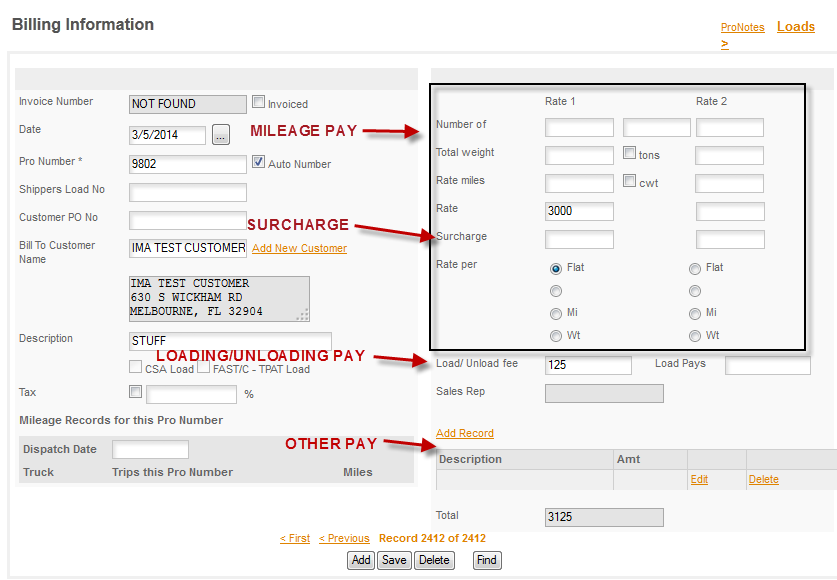

HOW IT WORKS - if you check the SPECIAL PAY box in payroll setup the LOAD PAYS box will appear on the Billing page. This box will only appear if you have one or more drivers set up for Special Pay. You then enter the amount you want to pay for the current load in this field when you enter the load. When you run payroll it will check the billing record to see if an amount is specified and will use that amount if one is there. If no amount is listed in billing the payroll will use the alternate method shown in payroll setup. You can use MILEAGE pay or PERCENTAGE as the alternate method.

NOTE: this method will only be used for drivers who have SPECIAL PAY checked. If you set it up for one driver it will appear on all Billing screens, but payroll will only use the field for drivers who have the Special Pay box checked.

SALES REP: Check the Sales Rep box if this person is paid a commission on loads they Broker or arrange. The Sales Rep can be paid a commission based on the billing for the load. Enter the Percentage you want to pay the Sales Rep in the Percentage section below.

PERCENTAGE PAY: If you pay this person based on a percentage of what was billed for the load enter the percentages here. The program will use individual percentages for:

Rate, which is a percentage of the base amount that the load was billed for.

Additional Pay, which is a percentage of any billing entered in the OTHER section on the billing page.

Load/Unload, which is the stated percentage of the amount entered on the billing page for Loading/Unloading

Surcharge, which is the stated percentage of the amount billed as a Surcharge

IMPORTANT: When entering the percentages remember you are entering a percent. So 100% is entered as 100. 10% is entered as 10 - do not use decimals unless they are part of the percentage. For example 10.5% would be entered as 10.5.

You can pay a different percentage for each of the items listed on the form. Take a look at the BILLING page and you'll be able to see how each section relates to the payroll setup. See the illustration below -

Setup the Percentage that you want for each section in the payroll setup. YOU CANNOT pay based on a "Percentage AFTER expenses" - or the rate minus the fuel, etc. The program will not make those calculations for you. So if want to pay a Percentage after expenses set the program to use the LOAD PAYS amount and then do the calculations for the amount you want to pay outside the program and enter it there. If you do that the program will pay that amount as the Mileage Pay and you will still be able to enter Loading, Other Pay and Surcharge separately.

COMBINING METHODS: The program will not calculate combined methods. For example, you cannot pay MILEAGE and have the program also pay for a Surcharge from Billing. If you pay based on MILES and want to include a surcharge you need to either add it to the Mileage rate in payroll setup or enter it manually in OTHER PAY. This also applies if you select LOAD PAYS and use MILEAGE as the alternate method. You can use LOAD PAYS and include both the Load Pays amount as Mileage Pay and the Loading, Other Pay & Surcharge as long as you use Percentage as the alternate method for payment when the load pays amount is not provided.