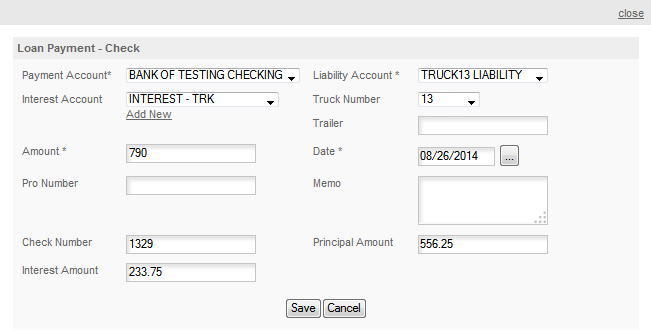

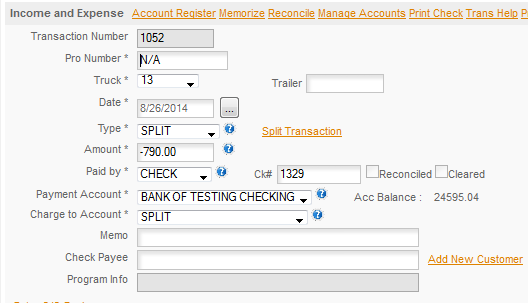

The popup is the same whether you're paying by CASH, CHECK or SAVINGS, the selection of the Paid By simply determines the Payment Accounts that the program loads.

To access the payment pop up click QUICK ENTRY/LIABILITY/and select the way you'll pay this.

Payment Account: Select the account you will use to make this payment from the drop down list .The program will load the available payment account of the type you clicked on when you opened the pop up (Cash, Check, Savings).

Liability Account: Select the loan that you want to make this payment on. Note: you must set this account up either in the Truck Maintenance Financial Details section or in the Open Account/Long Term Liability Account section for it to be listed here.

Interest Account: Select the interest expense account that you want the interest applied to. The program comes with the Interest - Trk account. If you want to use a different account for this simply add it in the

Quick Entry/Open Account/Charge To Account section. The account for the interest will be an expense account.

Truck Number: Optional though to increase report accuracy use the truck if the loan applies directly to the truck.

Trailer: Optional though to increase report accuracy use the trailer if the loan applies directly to the trailer.

Amount: Enter the total amount of the payment.

Date: Enter the date of the payment.

Pro Number: Leave blank, does not apply to this entry.

Memo: Enter any memo you want with this transaction.

Check Number: Click in the box and the program will load the next check number. You can edit it if that's not the correct check number.

Principal Amount & Interest Amount: The program will calculate the principal and interest based on the interest rate you entered when you set up the loan, the current principal and will use simple yearly interest. Since the payment will arrive at a different time the actual principal and interest will probably be different. To keep the account balanced accurately you will need to edit the Split entry (see below) with the actual amounts which you can get from the lender. Most lenders now have web site access to your account and you can get the actual amounts and edit the split so the principle and interest will be correct. See Quick Entry/Split

Entry/Editing A Split for details on editing the entry.

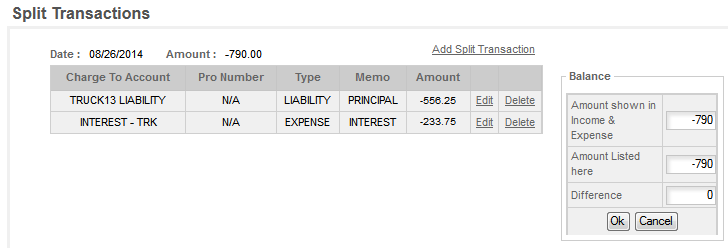

The split portion of the entry is shown below.

Here the Split is deducting $556.25 (principal) from the liability and expensing $233.75 for interest. The Liability is reported on the Balance Sheet and the Interest is reported as an expense on the P&L statement.