Other Features

TEAM DRIVER & PAY OWNER:

If this driver is a TEAM DRIVER CHECK THIS BOX FOR BOTH DRIVERS assigned to the truck. . This will allow you to pay loads which have already been paid to one driver to the other driver as well. Enter the appropriate rate for each driver under their individual Payroll Setup.

PAY OWNER: is used to pay a truck owner who has a truck leased on with you AND is paying the driver of the truck himself. You will set up the DRIVER in this section. You will enter the TRUCK OWNER in the ADDRESS BOOK as a TRUCK OWNER. When you check this box a popup will appear and you will select the truck owner from the popup.

NOTE: The truck owner MUST BE IN THE ADDRESS BOOK before you set up the the driver of the truck.

For this type of truck you will run the payroll for the DRIVER of the truck. Payroll will collect all the relevant information for the truck and will generate the payroll as usual. When you print the check the OWNER'S NAME will be on the check rather than the drivers. The 1099 for such a truck will also be put in the OWNERS name rather than the drivers.

PAY OWNER & COMPANY PAID DRIVER

For a situation where you have a truck leased on to you and you are providing or paying the owners driver, you will need to use this alternate procedure. Set up the driver as a company driver and assign him to this truck. You'll also want to check the Team Driver box AND LEAVE THE PAY OWNER BOX UNCHECKED You will then enter the Truck Owner in the Address Book, and you will set up a Co-Driver for this truck using TRUCK as his first name and OWNER as his second name. If you have more than one truck to do this for use a capitol I after each name. For example: Truck OwnerI, Truck OwnerII. You will need to use roman numbers to number the names as the program will not accept numbers in the name field. Leave the SSN, Birth Date, etc blank and save the record. You will assign both the driver and the co-driver (truck owner) to this truck. In LOADS when you assign the truck be sure both the DRIVER & the Co-Driver appear in the driver assignment section. That way the program will have all the records necessary for both the driver and the truck owner. You will CHECK THE PAY OWNER BOX for the co-driver. The co-driver will be set up as an Owner/Operator and you will enter all fuel and other deductible expenses that are paid for the truck as DRIVER ADVANCED to the Co-Driver. The payroll for the actual driver will not be brought in automatically so you will need to run the drivers payroll first, then calculate the gross amount of the pay plus any additional employer taxes you pay and enter that as a deduction as well. You can then pay the co-driver and the check amount will be correct and the settlement report will provide the necessary details for the truck owner.

HOW TO CALCULATE AND TRACK THE DRIVER PAY - This is based on the idea that you are charging the drivers pay back to the truck owner.

When you pay the driver print 2 copies of his settlement. 1 for the driver and 1 for the owner. You'll then use the one for the owner to send to the owner and to calculate your weekly deduction. You need to do this BEFORE YOU PAY THE OWNER. The best place to get the totals for a payroll is in the payroll section, click VIEW YTD while you are on the real drivers record. That will show you for each week the totals. To calculate the week for the driver - Go the to View YTD and then TOTAL the GROSS PAY+SS_EMPLOYER+MEDI+FUTA+SUTA and that will give you your total expenses for the employee for the week.

To Deduct This On The Owners Pay -

Add an account, QUICK ENTRY/OPEN ACCOUNT/CHARGE TO ACCOUNT - DRIVER PAY CHARGES and the type will be income. This is how you will account for the deduction from the owners pay. For your P&L statement this will wash the drivers pay off your expenses (the income will offset the expense for the driver) so your P&L will reflect the actual profit/loss you are having.

IF YOU CHARGE A MANAGEMENT FEE - you will need an additional Income account to charge that deduction to as well. That deduction can be set up automatically in the Payroll Setup page.

Add those by hand to the Driver Settlement and then do the Owners Pay. In the Deductions section you'll enter the total amount for the Management Fee as a separate entry. This will make it easier to track both items.

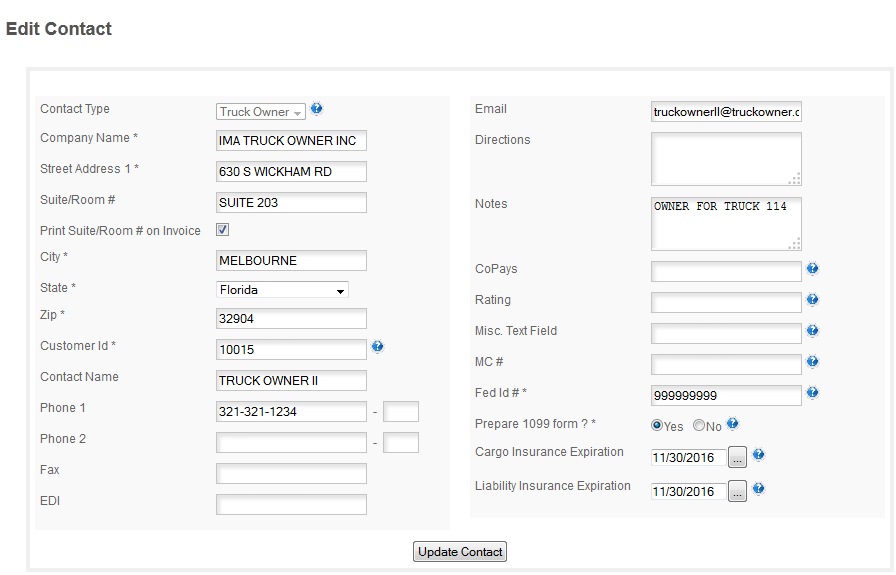

Here are examples for setting up the truck owner in the ADDRESS BOOK -

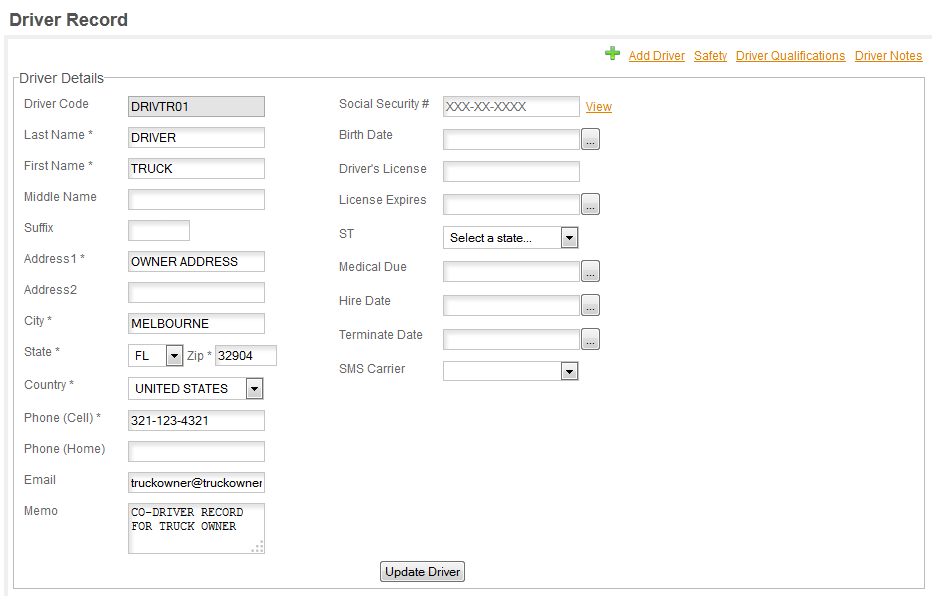

and for setting up the Co-Driver record in the Drivers section -

THE 1099 for the TRUCK OWNERS will be run under the CONTRACTORS section in our tax reporting, not in the payroll section. The 1099 will be for the Company Name and EIN (FedId#) which you enter in the Address Book. You do not need a SSN for this Co-Driver since you will never be paying any taxes for him. This method of tax reporting will allow you to assign as many trucks as necessary to a single owner. The program will not accumulate checks for the owner, you will still need to run payroll for each truck individually. You can then pay individually with separate checks or run the settlement reports for each payroll and then total them and cut a single check for all of them. To record the check number for each payroll in the payroll section simply enter the check number manually in the Do Payroll page before you export the payroll.

TAX TABLES & ASSIGN TRUCK:

Tax Tables will only need to be accessed if you need to add a special tax to the tables. The Federal and State tables are updated automatically in the program and you cannot edit the standard federal or state tables. The program uses the same table for ALL users of the Truckers Helper Online so individual tables are not allowed for these two categories.

ASSIGN TRUCK: This will appear automatically when you are entering a new employee. If a drivers truck assignment changes you will click here to open the Truck Assignment popup and assign the new truck to the driver. See Assign Truck for details on using the truck assignment section.