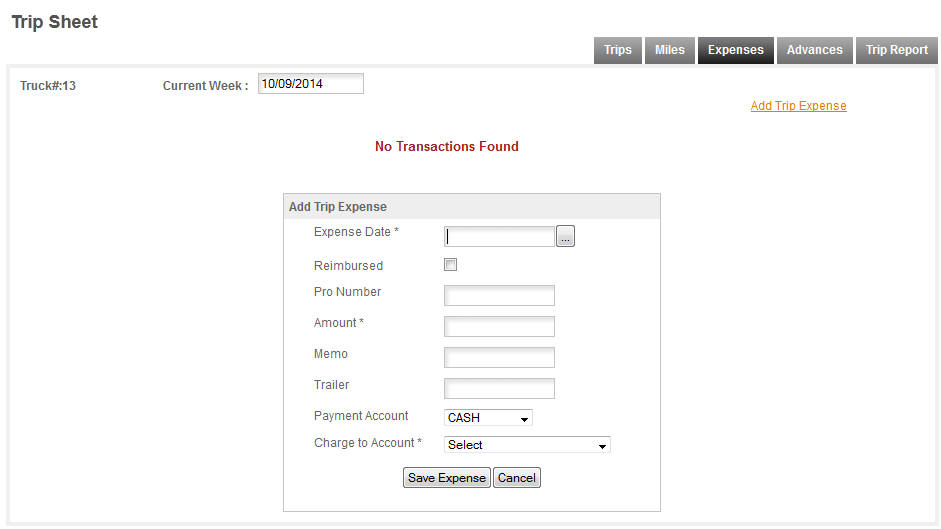

Like Miles the Expenses can be entered on the Trip Sheet or in the Income & Expense section. On the Menu Bar, click ACCOUNTING/INCOME-EXPENSE to access the Income & Expense section. You can also access it from the ACCOUNTING FLOW by clicking the Open Account icon. Again, we recommend that you stick with the Trip Sheet for entering your expenses for the week. The format is easier to follow and the page is less complex. The Income & Expense page is the programs single source for all your accounting so it has a lot of options and requirements that you can avoid by using the Trip Sheet Expense section. Like the Miles page the section will tell you No Transactions Found if there are no entries in the I&E section for the current week. Click ADD TRIP EXPENSE and you'll get the Add box -

You will use this same box for all your entries in the Expense section. The expected information is detailed below -

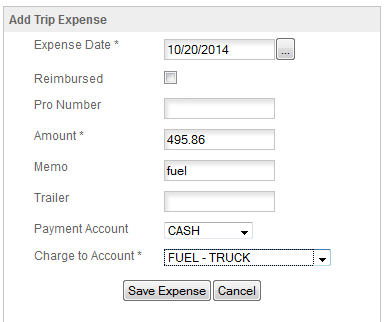

EXPENSE DATE: The date of the expense. This must be within the current reporting cycle (a week is the default when you first start).

REIMBURSED: Check this box if the expense you are entering will be reimbursed by your company.

PRO NUMBER: The Pro Number is defined in detail in the Glossary so we won't repeat the long meaning here. Suffice it to say this is the number that you will use to keep track of a load and all the income, expenses and related things that are required to track that load. In order to decide if you need to use the Pro Number or not you'll ask yourself does this item relate DIRECTLY to the trip (load). If it does then you enter the Pro Number if it doesn't you use N/A or leave it blank and the program will enter N/A for you.

EXAMPLES: A lumper relates directly to the trip, the gloves you bought to use unloading the trailer do not as you will go on using them for other trips. FUEL does not relate to the trip as fuel is used for all trips and you do not replace the used fuel every trip. Tolls on the other hand relate directly to the trip you are on when you incur the toll.

AMOUNT: Enter the amount of the expense.

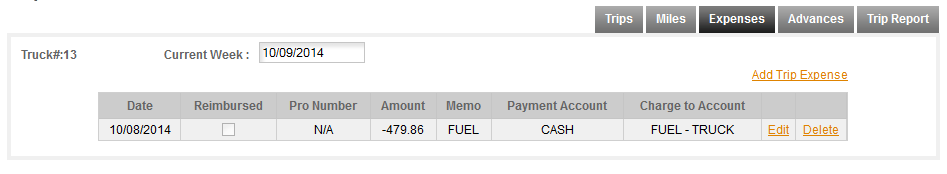

NOTE: the program uses a minus sign (-) when entering items paid from a Cash account. DO NOT CHANGE THESE SIGNS. If the program set something a particular way finding a way to change it (we've worked at eliminating those where we can, but if you're persistent enough you may find a way). Changing it may cause errors in your reports and/or accounting records.

MEMO: Enter any memo you want with this transaction. KEEP THEM BRIEF this is a memo field, not a open text field.

TRAILER: If this expense applies to the trailer enter the trailer number.

PAYMENT ACCOUNT: Select the payment account you want to use from the Drop Down list. If the account is not there you will need to go to the Income & Expense page to

Open The Account.

CHARGE TO ACCOUNT: This is what the expense was for. Select from the list, or if you want to specify a new expense account click the ADD NEW link at the top of the drop down list.

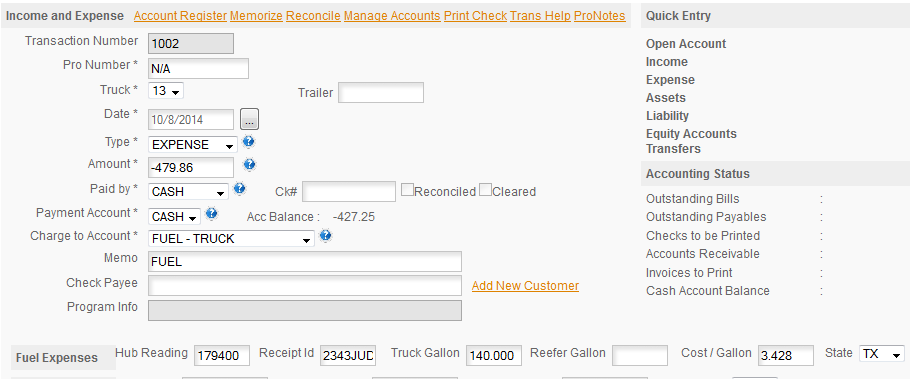

FUEL ENTRY - here's an example of a fuel entry for the current week -

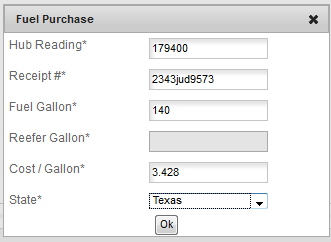

Pro Numbers do not apply to fuel since the fuel usually overlaps trips it is considered a general expense. So the Pro Number box is left empty. The same applies to the trailer as this was truck fuel. A trailer number would apply to Fuel - Refer. We paid for the fuel with CASH. If you have a fuel card or other charge card you use to pay for fuel set this up in the Income & Expense section as referenced above. For fuel, when you click Save you'll get the Fuel Detail popup -

This box is used to provide the program with the information that it needs for IFTA reporting and to keep track of your current MPG. Fill out this form (all fields are required). When you enter the number of gallons the program will automatically calculate the Cost/Gallon for you. When you save the entry it will save to the expense page -

The data is also used to create an entry in the Income & Expense (Accounting) section of the program.

For details on the Income & Expense section please see the main help for

Income & Expenses.