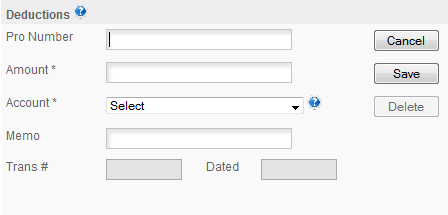

Deductions

When you click IMPORT the program will import any Driver Advances, Charge Backs and any deductions that are set up in Payroll Setup and marked as currently active. You can also enter one time deductions here for other items.

Note that DRIVER ADVANCES & CHARGE BACKS MUST BE ENTERED IN I&E FIRST. Driver Advanced, and Charge Back are both special account names that the program uses to activate the special processes that are used to account for and track these items. See the Driver Advances & Charge Back topics for more details.

FIELDS -

Pro Number: this is imported from the I&E transaction for Advances and Charge Backs. Can be entered manually for deductions that are not imported.

Amount: the amount of the deduction.

Account: this will be the account to charge this transaction to. It MUST BE an income or liability account. You cannot withhold payroll against expense accounts. Do not try to withhold against an expense account that you will later make a payment on. For example you have an expense account for Truck Insurance. Then the account in would need to be Truck Insurance Driver, or something like that and would be set up as an Income account. The other way to deal with this (so you are not showing the driver deductions as income) is to set up a Liability account named Truck Insurance. When the bill comes you pay it from the liability account.

See I&E/QUICK ENTRY/LIABILITY/PAYMENTS ON A CHARGE ACCOUNT for details on how to do this.

Memo: a short memo field for notes associated with this transaction

Trans #: the transaction number from the I&E section for Advances & Charge Backs.

Dates: the date of the above transaction.

BUTTONS -

Cancel/Add: section starts in Add mode. Button changes to Add after the first record is saved or imported.

Save: save the current record.

Delete: delete the currently displayed record.

See Running A Payroll for step by step instructions on running a payroll.