One Truck Version: If you are using the One Truck version we recommend that you use the Trip Sheet to track your Income & Expenses rather than entering them here. This category can be used by a company driver or a leased Owner/Operator if you are not using the Trip Sheet. We'd recommend that you only use it for Advances and use the Settlement Sheet instead for entering your actual Settlements.

Fleet Version: This category is not generally used by or useful for the Fleet Version of the program where revenue is created by Invoicing and payments on your Receivables. See Accounts Receivable for entering payments received on your receivables. The below instructions are designed for Company Driver or Leased Owner/Operator.

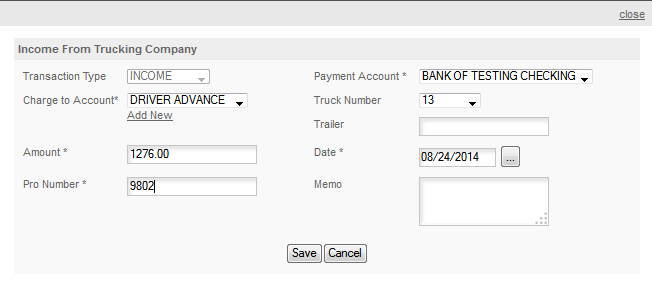

Transaction Type: This is set by the program and cannot be edited here.

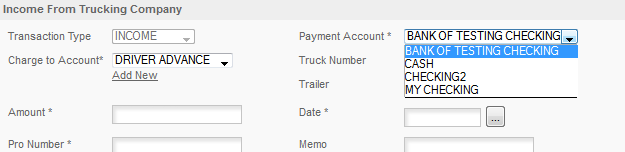

Payment Account: The drop down list will give you a choice of your CASH accounts. If your money was put into an account which you have set up as a charge account, such as a fuel card or similar credit account, you will need to edit the entry after it's created or make the entry manually. Another option is to put the advance into the CASH account and then spend it from there. Select the account you deposited the money into.

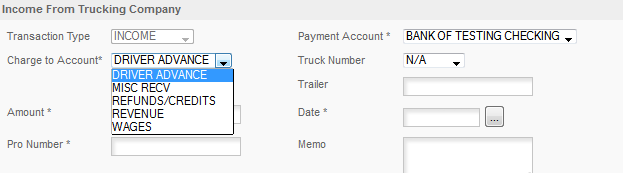

Charge To Account: The program lists all the INCOME type accounts. A few of these do not really apply to this category. Well note those below. Your options are:

Driver Advance - A driver advance is considered payroll. Truckers Helper does not use the 'fuel advance' concept. Once money is given to a driver or owner/operator that money is his. If you received a 'fuel advance' or an advance under some other name to cover your trip cost enter it as a driver advance. If you spend it on reimbursable expenses turn in receipts for those expenses so you can be reimbursed for them.

Misc. Recv. - DOES NOT APPLY TO THIS CATEGORY OF INCOME

Refunds - Credits - this can be used if you received an adjustment on your settlement which doesn't fit into another category.

Revenue, Wages - This would be the category to use for any pay received. You will get better records if you use the Settlement page to enter your Settlements. It will break down the payment by Pro Number and income type.

Truck Number: Enter your truck number if this is truck related pay.

Trailer Number: This does not apply to this category of income. You can fill it in or leave it blank.

Amount: The amount you received.

Date: The date you received the payment.

Pro Number: Enter the Pro Number you were paid for. For Driver Advances this is very important as the Pro Number is how the program knows which payment to close when the Advance is settled. For trip pay, this is again why we recommend using the Settlement page, it breaks down the settlement by Pro Number.

Memo: Enter any memo you want with this entry.

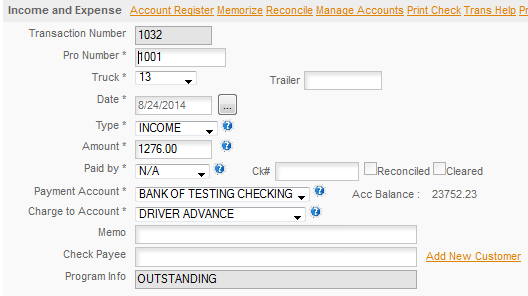

Below is the transaction created for the above form -

Note the OUTSTANDING in the Program Info. Since this was a Driver Advance the program uses this field, which cannot be edited manually, to track what advances are outstanding. When the entry is settled the program will change that field to SETTLED - MM/DD/YYYY where MM/DD/YYYY is the week ended date of the Settlement that settled this advance. The Pro Number is used to determine which advances are settled so always use the Pro Number for the trip you are on when you receive an advance.