Reimbursed Expenses

A Reimbursed Expense occurs when you pay something for someone else who will then later reimburse you for the expense. Be sure to use the Pro Number that relates to this reimbursement when you enter it as the program uses the Pro Number and the Amount to match up the reimbursement with the original expense. Reimbursed Expenses are treated by the program as Receivables and are not treated as Income for tax purposes. They will not be reported on your Profit & Loss statement. Outstanding Reimbursements will be shown as an Asset on your Balance Sheet.

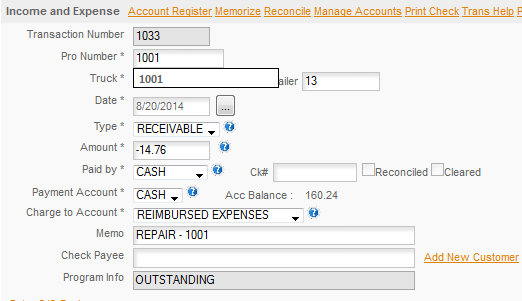

Transaction Type: Set by program and cannot be edited.

Payment Account: Select the Cash or Charge account that you used to pay for this reimbursement.

Charge To Account: Set by program and cannot be edited.

Truck Number: Optional, use if the expense related to the truck.

Trailer Number: Optional, use if the expense related to the trailer

Amount: Enter the amount of the expense.

Date: Enter the date the expense was incurred.

Pro Number: Enter the associated Pro Number

Memo: Leave blank the program will use this for the popup that will appear when you click SAVE.

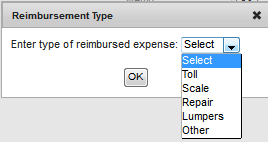

Click SAVE and the Reimbursement Type popup will appear -

Select the type (what this was for) from the popup. It will put your selection in the Memo field and create the transaction.

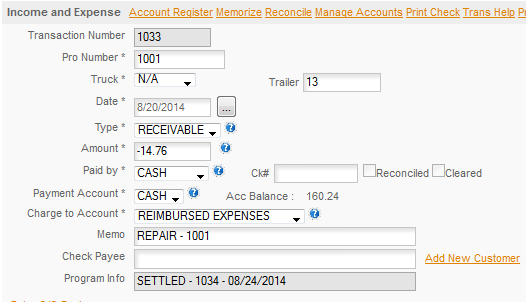

Note: the Program info. This will be updated when the transaction is settled.

SEE: QUICK ENTRY/INCOME/REIMBURSED EXPENSE for details on entering the payment when it's received.