Refunds

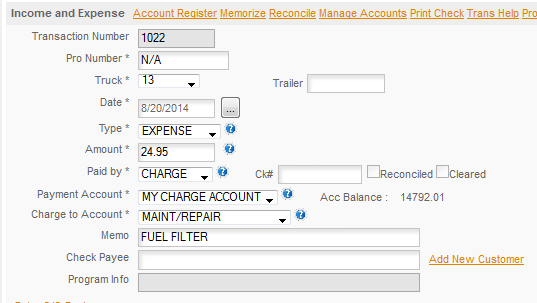

For our example we'll purchase a fuel filter. When we get home we discover they gave us the wrong filter and return it. They don't have what we need so they give us a refund. So here's the purchase -

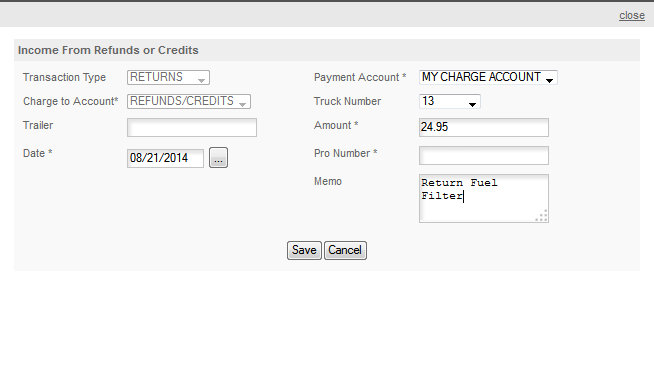

Next up we click QUICK ENTRY/INCOME/REFUNDS

Transaction Type & Charge To Account are fixed fields. We'll edit the Charge To Account after the entry is made.

Payment Account is the account the money will go back in to. In this case it was our credit card which we named My Charge Account.

Truck Number: We entered the truck number on the original purchase so we enter it here as well. That insures the expense won't show up against the truck in reports.

Trailer Number and Pro Number were not used so we leave those blank.

Date: We select or enter the date of the return.

Memo: We enter a memo we want with this transaction. Then we click SAVE and the program creates the return.

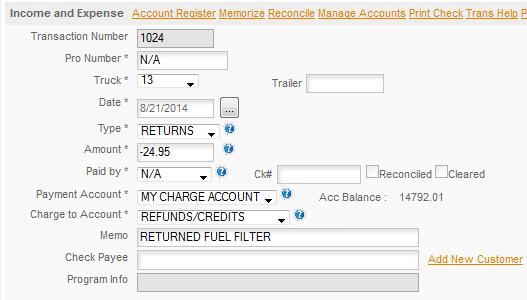

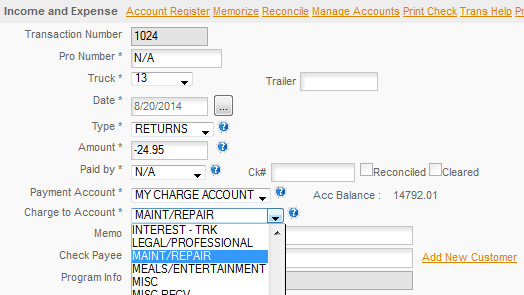

As we noted above, the CHARGE TO ACCOUNT is listed as Refunds/Credits and we want to change it to match the original expense. So we'll change it to MAINT/REPAIR. Click the Charge To Account and select the account from the drop down accounts list -

Now click SAVE to save our update and we have now entered the return. We've entered the return against the credit card so it'll show up when we go to reconcile the credit card and we've removed the expense so it won't show up against the truck on the Maint/Repair expense account. We can check the register to be sure that's what happened.

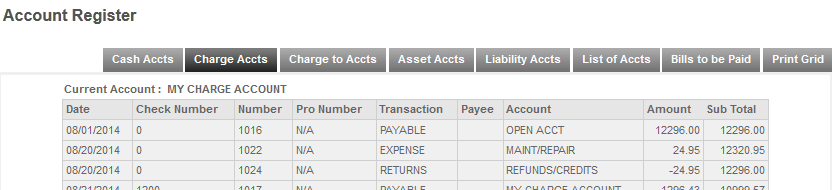

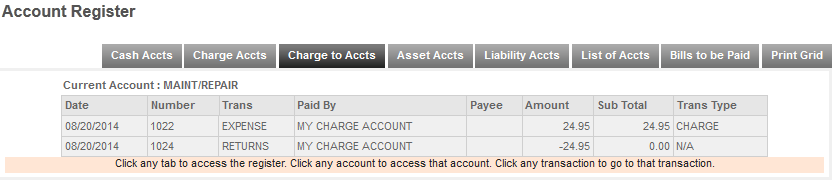

Above we see that the credit card was credited back - Below we see the expense account was also cleared.

The register is very handy for checking that things worked the way you expected. See the Account Register topic for details on the register.