Negative Payroll

Occasionally you may run into issue where you need to run a payroll that ends up with a negative balance. The program handles this by paying the payroll with the NEGATIVE PAYROLL. This is a special account the program uses for this situation. It will pay the payroll from this account and then create a Driver Advanced entry to offset the balance in the Negative Payroll account. Negative Payroll should never have a balance in it and should never be used for any purpose other than the intended payroll use.

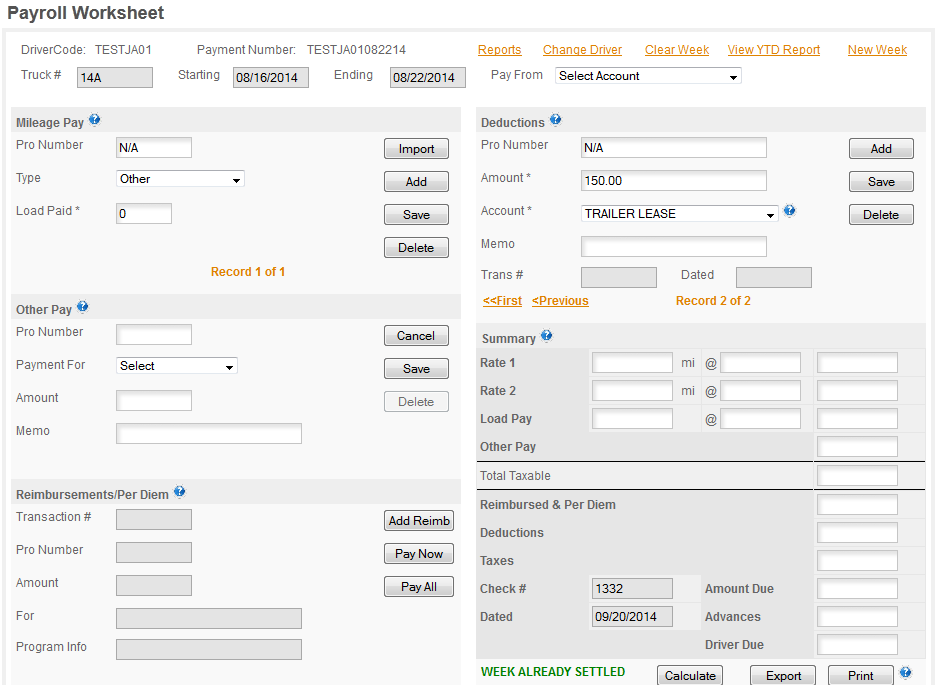

For our example we have a week where the driver has not trips and has deductions for Truck Insurance and a Trailer Lease Fee which are due every week. To run this payroll you click on NEW WEEK, start the New Week and then click IMPORT. The program will then import the regularly schedule deductions which are entered in Payroll Setup. If there are also any outstanding Driver Advances the program will ask if you want to import these as well. Generally it's best to leave those and let them be settled individually. Here's the Payroll Screen after the payroll is run and Settled -

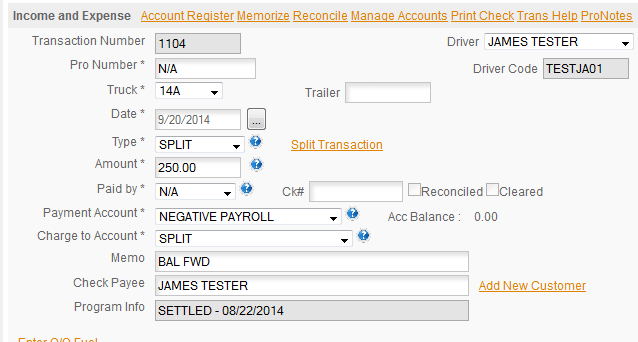

The export has created two entries in Income & Expenses. The first is the Payroll entry -

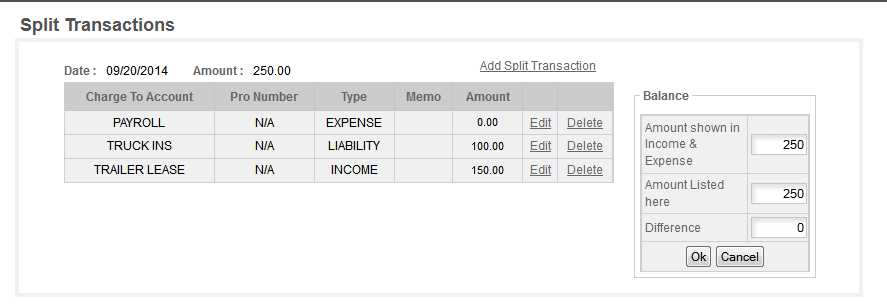

Notice this has been paid by Negative Payroll and the amount is positive. So this is treated as a deposit into the Negative Payroll account. The split entry for this shows the details -

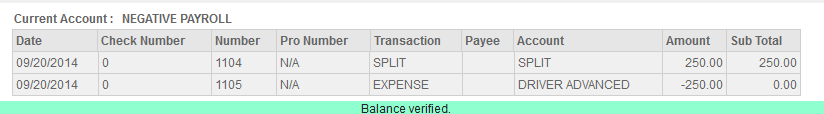

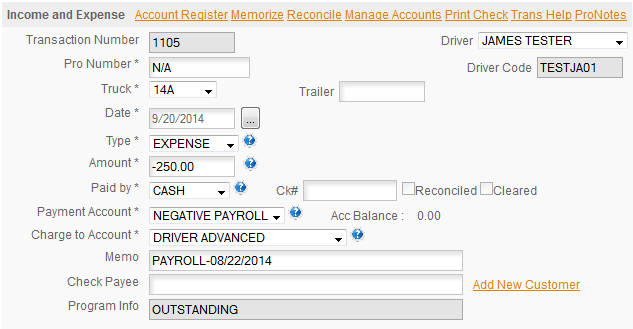

The second entry (next page) is the Driver Advance which will be a negative entry and will restore the Negative Payroll to a zero balance -

The second transaction is for the Driver Advanced entry -

This same process will always occur when you have a negative payroll. This can occur if a driver with weekly deductions is off, if the driver is off miles and high on advances and other deductions, or for other reasons. If the driver has some pay and is a taxable employee income and related payroll taxes will be withheld on the pay amount. Taxable is based on earnings not NET pay so if a driver, for example took $1000 in advances and then only earned $800 for the week, he'd be taxed on the $800 and have a negative payroll for the $200 he was over advanced and the amount of his taxes. It is also important to settle driver advances in the next payroll. It is easy to get into a cycle where the driver is always short at the end of the week and the advances can quickly grow to a large outstanding amount.