Money Deposited

OWNER DEPOSIT occurs when the owner puts money into the business directly or when the owner purchases some item or pays some expense for the company out of his own personal funds. It's not uncommon for owners to do this especially in the early years of the company. For this example we are going to show the entries required when the owner purchases something for the business from his own money. This is handled by showing the purchase first as a Owner Deposit to the CASH account. This will put the money (value) into the Cash account. From there the money (value) will be expensed as a business expense.

If the deposit is an actual deposit to one of the cash accounts this would be a single entry simply showing the deposit into the appropriate Cash, Checking or Savings account involved. If, however, the owner pays a bill for the company or purchases something for the company from his person funds a transaction similar to this one will always be used. First deposit the money to the cash account and then pay the bill or purchase the item from the cash account.

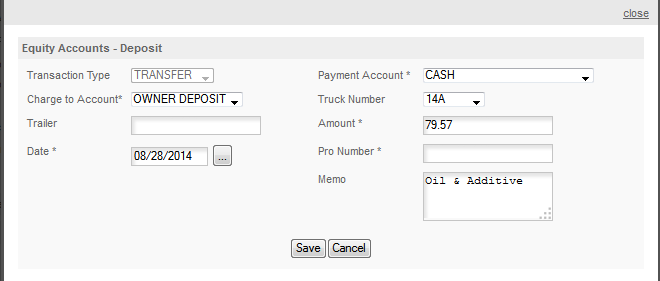

To access the Owner Deposit pop up click QUICK ENTRY/EQUITY ACCOUNTS/MONEY DEPOSITED and the popup will appear.

Transaction Type: Set by program cannot be edited.

Payment Account: Select the account you will deposit the money into.

Charge To Account: Set by program cannot be edited.

Truck Number: Optional

Trailer Number: Optional

Amount: Enter the amount of the deposit or purchase if this is to transfer a purchase to an Owner Deposit.

Date: Enter the date the deposit is received.

Pro Number: Not used here. Program will fill in N/A

Memo: Enter any memo you want with this transaction.

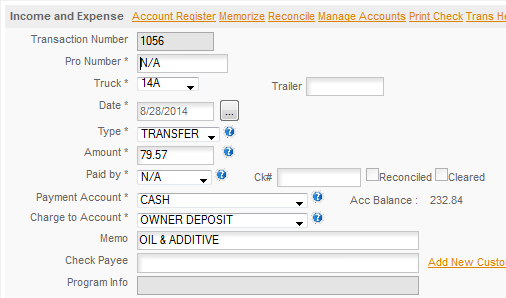

This entry will then generate the following Owner Deposit transaction -

This transaction deposits the Value of the purchase into the Cash account. Next we'll enter the receipt into the program and show it paid by Cash.

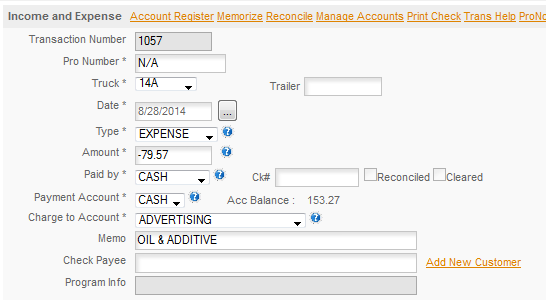

This then transfers that Value to the company and expenses the purchase.