Long Term Liability

A Long Term Liability is used when you have a 'fixed' loan for something. Examples would be purchasing a truck, trailer or property for a yard or repair facility. If you are purchasing a truck we suggest that you use the Truck Maintenance section to set the truck up and fill in the Financial Details to have the program create the Liability Account for you. It can be done either way, but this Maintenance Setup can automated the process for you.

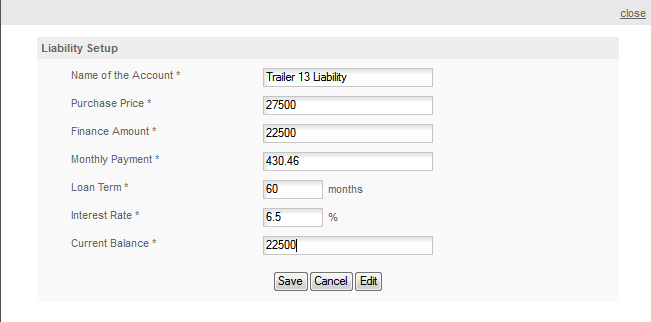

To set up a Long Term Liability click on QUCK ENTRY/OPEN ACCOUNTS/LONG TERM LIABILITY and the popup will appear.

Name Of Account: The name for this account. We suggest using Liability and Asset to the end of the name. You can then use the same name for both which makes it easier to remember and see what's for what (Trailer 13 Asset for the asset and Trailer 13 Liability for the liability)

Purchase Price: This is the total amount you paid less any taxes and license fees. This will be the Value of the asset account when you initially set it up.

Finance Amount: The amount you originally financed.

Monthly Payment: The total amount of your monthly payment.

Loan Term: The number of months on the loan.

Interest Rate: The yearly interest rate.

Current Balance: This will be the amount the program opens the liability account for.

Note: The principal and interest will be calculated by the program using a simple yearly interest calculation (Principal * Interest Rate)/12. Your actual Principal & Interest will probably vary from this amount so you will need to adjust the split entry the program generates for your payment.

We suggest setting up loan payments as a MEMORIZED TRANSACTION in Truckers Helper and as an automated payment from your bank so you don't forget or incur late fees on the payment. Truckers Helper will remind you when the payment is due if you set it up as a Memorized Transaction.