Liability

This section will deal with short term liabilities. A liability is something that you owe to someone else. Charge Accounts and Credit Cards are both considered short term liabilities as is a Line of Credit if it has an outstanding balance. For Credit Cards and Charge Accounts see CHARGE - This section is aimed at short term liabilities such as a Line Of Credit or something similar. To open a short term liability - Click QUICK ENTRY-OPEN ACCOUNT-LIABILITY and the popup will appear.

NOTE: For 'Long Term Liability' such as a truck loan or major loans see the Long Term Liability topic.

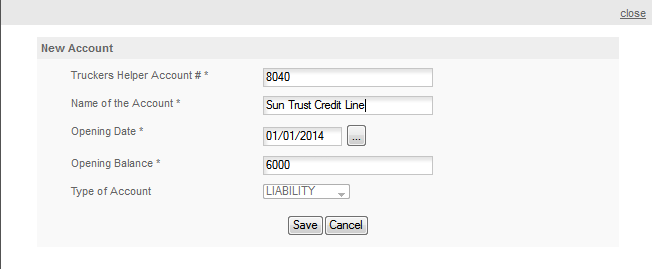

To open a short term liability - Click QUICK ENTRY-OPEN ACCOUNT-LIABILITY and the popup will appear.

Truckers Helper Account#: The program will provide the next available number or you can enter your own account number.

Name of the Account: Enter the name you want for this account.

Opening Date: The date you want to use for the opening balance.

Opening Balance: This should be the balance on the account before any entries that you plan to make after the account is created. If you are bringing in a prior balance, a balance for amounts taken before you set up your books, you should open this account as part of your initial setup so it's included in the opening Equity balance.

Type of Account: This is fixed and cannot be edited.

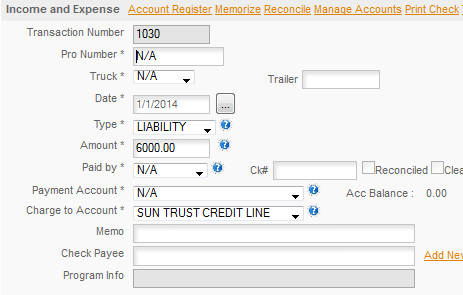

Below is the entry created by the open account entry above.

Note: If this is a new loan and you put the money in the bank you would EDIT this transaction by Adding the Bank in the Payment Account section. This would have the effect of creating a liability for $6000 and adding that same $6000 to your bank balance which makes the Balance Sheet balance.

This is a Balance Sheet item so be sure to see Setup Accounting - Your Balance Sheet and Articles - Understanding Balance Sheet vs Profit & Loss to be sure you understand how Balance Sheet accounts work. A Line Of Credit is considered a loan, so the cash is not included in Income and the payments are not included in Expenses. Interest you pay on the loan is an expense, payments would be type LIABILITY with a Negative Amount and the interest type EXPENSE and also a negative amount assuming the payment is made from a CASH account. This would be entered in a split entry.