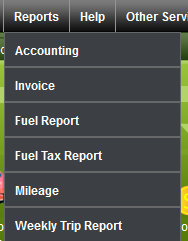

Fuel Tax Report

The options for the Fuel Tax report are all handled with a series of popup windows when the report is called. The first popup is the primary selector -

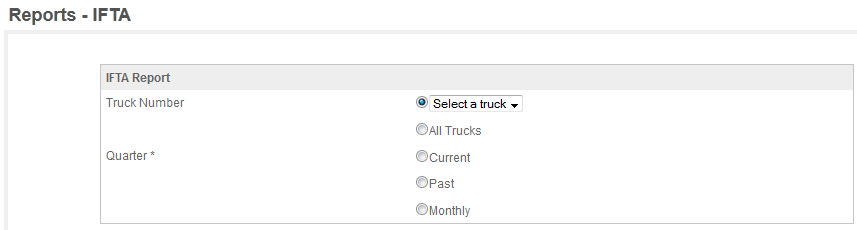

You can run the report for a single truck or for All Trucks and for the Current or a Past quarter as well as for a given month. Choosing Current will run the report without further date identification. Selecting Past or Monthly will give you further date qualifiers to determine the exact period to report after a couple other qualifiers - first the IFTA Report Style - Print only states with miles run or the Print all states selection -

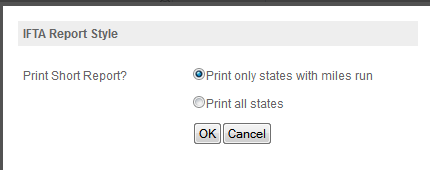

Followed by the IFTA Report Type. This is where you select the IFTA report or the Road Tax report.

.

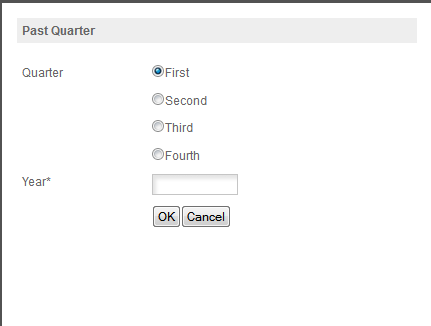

. Next, if you selected Past for the Quarter you'll get the quarter/year selector -

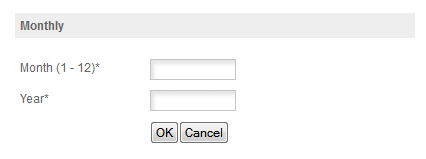

Or if you selected Month you'll get the month/year selector -

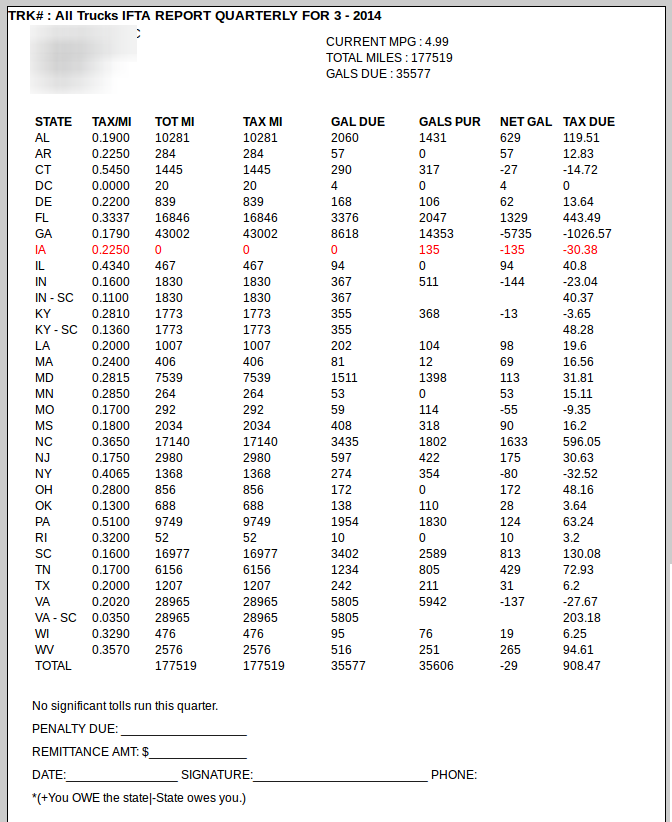

Next you'll get the report. Note on the report IA - which shows a fuel purchase by no miles. You can run miles in a state with no fuel purchases but you cannot purchase fuel in a state without running at least 1 miles in the state. The program will catch this error and print that state in RED to point out the error so you can correct it.

.

At the top of the report you will get your overall fleet average MPG, the total miles and the total gallons of fuel purchased. This is the number used for the IFTA calculations in the report.

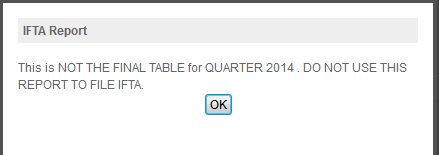

Next let's look at a couple of error messages you may see. If you are running the report for the current quarter before the end of the quarter you may get the 'not the final table' warning -

and the other warning we see sometimes is the No Records Found issue -

This message means that the program could not find any miles OR it could not find any fuel purchases for the truck(s) and the time period you selected. Check your date and truck selection. To date we've never had anyone get this message in error, so check the Miles and the Income & Expense for fuel entries for the truck or truck(s) and the time period you selected. This message is especially common the end of the quarter. On 4/2, when there are not yet entries for the second quarter clicking CURRENT QUARTER for the report on the first quarter will get you thin message. Be sure that you are always asking for the right report.

FILING YOUR REPORT - we have found that many jurisdictions will accept our report as is attached to the form which the state mailed you. BUT DO NOT ASSUME THEY WILL - this seems to vary by the individual office, so for starters fill out their form using the data on the THO report. Send a letter with this and our report attached asking if you can submit our report without transferring the data to their form. They'll let you know. Many states have now gone to an electronic form and we will be looking as adding the functionality to submit the data electronically as soon as we can. For now, you can use your print out to fill in their online form.

ROAD TAX - we do not automatically update the road tax every quarter! Please verify the amount in the report against the road tax form you are using. Let us know when they are different and we'll update our online information.