Driver Advances

Driver Advances should be entered in the Income & Expense section when they are issued. The payroll will then import them into payroll when you click IMPORT and settle them. See the INCOME & EXPENSES/QUICK ENTRY/DRIVER ADVANCES for more details and Search for Driver Advance in the PDF and Online versions of the manual as it's mentioned in several places.

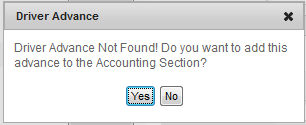

You can also enter a Driver Advance when you are running payroll. In the Deductions section click Add and complete the form. The program will located the matching Advanced entry for this driver and if it cannot find it will tell you and give you the option of adding it to Income & Expenses now.

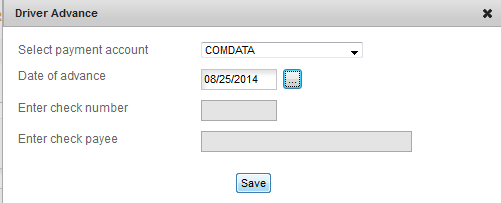

Click YES to add the advance to the I&E section and then enter the missing details -

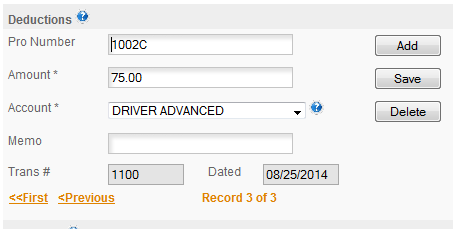

If the payment account was a Checking account you would also enter the check number. The program will provide the next number for you or you can enter your own number. Enter the date of the advance and click Save. The advance will then be added to the deductions. Note the Trans# & Date at the bottom of the window -

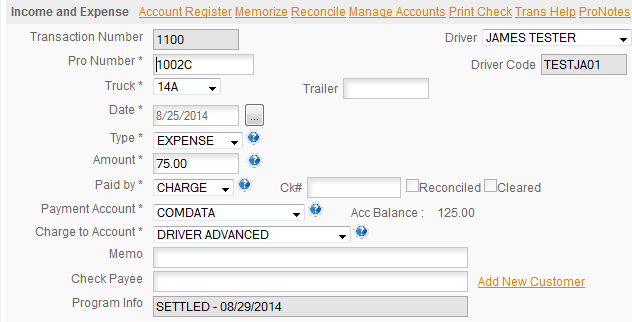

and here's transaction 1100 -

DRIVER ADVANCES WILL ALWAYS HAVE A MATCHING INCOME& EXPENSE TRANSACTION! The way the program works, the Advance, while outstanding is reported on your P&L as Driver Advanced. when the advance is settled the expense amount from the advance is transferred to the pay for the load the advance was paid against, the advanced entry is then marked SETTLED - DATE and the program ignores it for reporting after that. So for accounting purposes Advanced amounts are treated as payroll. Once you give a driver an advance it is the drivers, if he gets out of the truck and walks he has the money. It's not a 'fuel' advance. He may spend it for fuel and if you pay for fuel he would then turn in the receipt and get reimbursed for the fuel, but the advance itself is his once you give it to him and that is how the program treats it.