Draw Taken

In a Sole Proprietorship (a single owner business), an LLC (Limited Liability Company) and a S Corporation income passes through the company and directly to the owner. So in these types of organizations, which are the more common among our users, the owner is the business. So the owner is not paid through payroll. Instead the owner takes a draw or makes a deposit into the fund of the company. So an owner is paid by taking and OWNER DRAW. This is a transfer from the company to the owner and can be handled in Truckers Helper Online as a single entry. Fill out the form below to create an owner draw transaction -

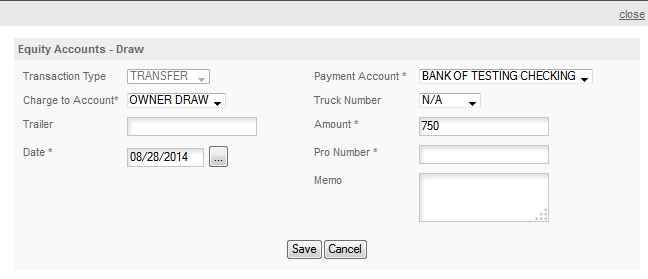

To access the Owner Draw (Draw Taken) popup click QUICK ENTRY/EQUITY/DRAW TAKEN and the popup will appear -

Transaction Type: Set by program cannot be edited.

Payment Account: Select the account you will take the draw from. The Cash & Credit accounts are in the drop down.

Charge To Account: Set by program cannot be edited.

Truck Number: Optional

Trailer Number: Optional

Amount: Enter the amount of the draw.

Date: Enter the date the draw is taken.

Pro Number: Not used for this transaction.

Memo: Enter any memo you want with this transaction.

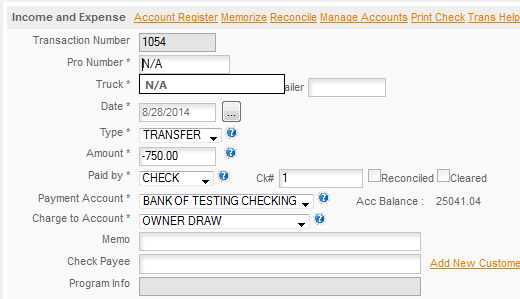

When you click SAVE the Check Number box will appear. For this entry, we used a Debit card to withdraw the draw from our bank account so we use Check 1. Remember Check #1 is reserved for electronic transactions.

The program will then create the following entry for the Owner Draw.

The type of Owner Draw will always be TRANSFER as this is transferring money from the company to the owner.