Depreciate

Generally depreciation is taken once a year at tax time. Talk to your accountant or tax person about this. Generally they will give you a list of the things that are depreciated and how much depreciation was taken on each. If you have a number of items you can do one split entry for all of them or you can do them individually here. This function will depreciate one item and create both entries, one to reduce the value of the asset and the other to expense the depreciation.

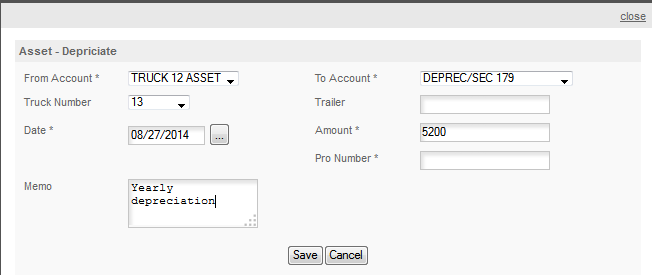

To access this popup click on QUICK ENTRY/ASSETS/DEPRECIATE -

From Account: Select the Asset that you want to depreciate from the drop down.

To Account: Select the depreciation account you want to use or use the system Deprec/Sec 179 account.

Truck Number: Optional

Trailer Number: Optional

Date: Enter the date that the depreciation applies to. This is usually the end of your year.

Amount: Enter the amount of the depreciation.

Pro Number: Does not apply to this entry.

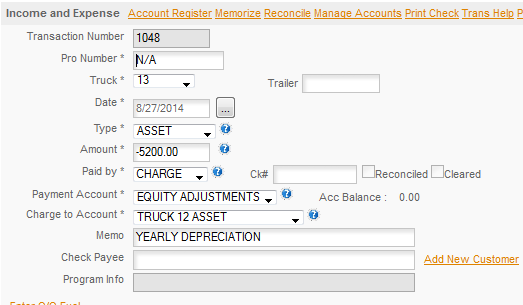

Fill out the form and click SAVE to create the appropriate entries in I&E. Below is the first entry the program will create. This entry reduces the value of the Asset by the amount of the depreciation.

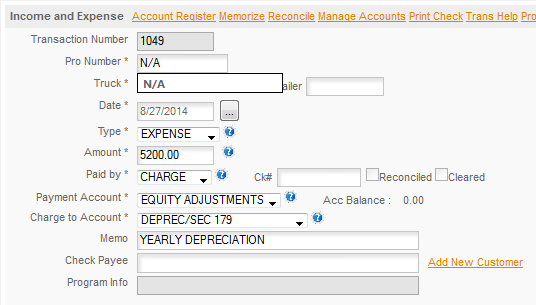

The second entry expenses the depreciation off. If you do not have the Equity Adjustments account the program will create this account for you. It is used by the program to account for adjustments such as this one.

For an example of a Split Entry used to depreciate a number of items in a single entry see the Split Entry/Depreciation/Depreciate Multiple Assets topic.