Depreciate Multiple Assets

Often at the end of the year you'll get a list of items to depreciate from your accountant. You can use the split entry to handle this. If you have a single item to depreciate then please see the Quick Entry/Asset/Depreciate for an example of handling that. This topic if for depreciating multiple items at the same time. The principal is the same whether it's one item or a dozen, but it's often clearer to see an example, so we're providing this topic to give you that example.

For our example we are going to depreciate a truck, an APU for the truck and a shop building. Here's the main transaction -

Depreciation can be handled two ways for this entry we're going to handle it as a straight depreciation that is applied to the asset we're depreciating. For this type of transaction it's all paper values - we are going to add to depreciation and subtract from the asset. In the next example we'll apply it to Accumulated Depreciation, which as I said in another topic is considered a negative asset. For the transaction above the Split will be -

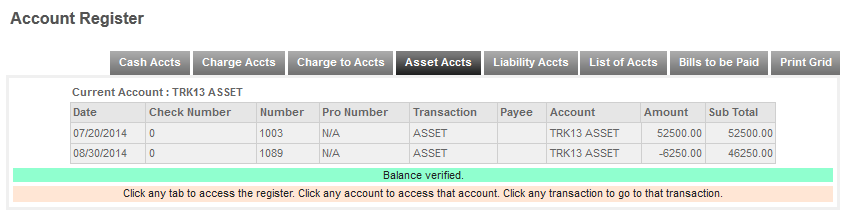

To check that these worked as expected you can check the Account Register. We'll look at the first entry, Truck 13

Ok, next let's talk for a second about Accumulated Depreciation. The idea here is that instead of showing the depreciation in the Asset like we did above, the depreciation is shown in the Accumulated Depreciation account. This is a negative Asset account, so it will still balance the Balance Sheet and at the same time will leave the original value of the Asset alone. So you can now see readily what the original value of the asset or assets as the case may be were and then the amount that has been depreciated from them. The bad part of this is that you can't readily see how much each assets current book value is, this you have to go back and calculate from the Accumulated Asset account.

To assign these entries to the Accumulated Depreciation account we'd simply change the ASSET account that we've assigned above to Accumulated Depreciation. The rest of the entry would stay the same. So the split would be -

and on the Balance Sheet the Asset section shows the assets at their original purchase value and show a negative asset for the Accumulated Depreciation.

In the end the Net Worth is still the same either way, one way we identify the Book Value of each asset individually and in the other we don't. So you can do it whichever way you prefer but your accountant will probably do the Accumulated Depreciation method.