Charge Backs

A Charge Back occurs when you need to charge a driver for some shortage, over payment or other issue which was previously paid to the driver. For example, a load is delivered, the driver is paid for the load and after the payroll is run and disbursed you get a shortage or damaged item claim from the receiver. You pay that claim and then need to charge the driver for the damages. You use a Charge Back to do that.

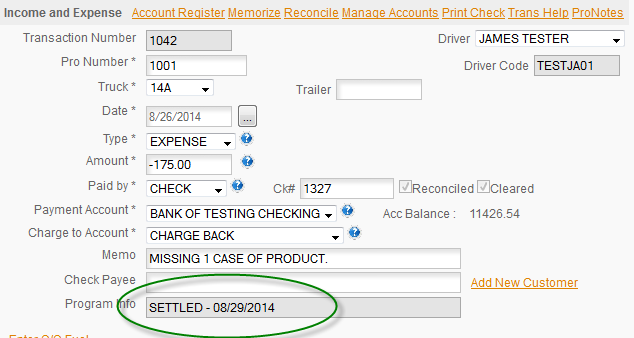

Charge Backs need to be entered in the Income & Expense section. See

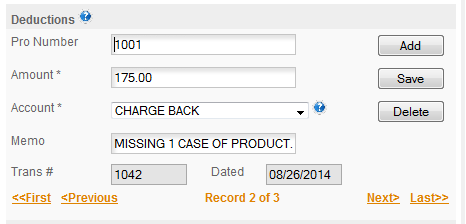

INCOME & EXPENSE/QUICK ENTRY/EXPENSE/DRIVER CHARGE BACK for how to make that entry and/or see the sample below. Once the entry is in the I&E section the program will import the Charge Back when you click the IMPORT button and reply YES to the import ALL DRIVER ADVANCES popup. A Charge Back is treated by the program in the same way a Driver Advanced entry is treated. The Charge Back will be brought into Deductions -

and the transaction will be marked as Settled -