Balancing Your Balance Sheet

NEEDS EDITING AND UPDATING FOR THO

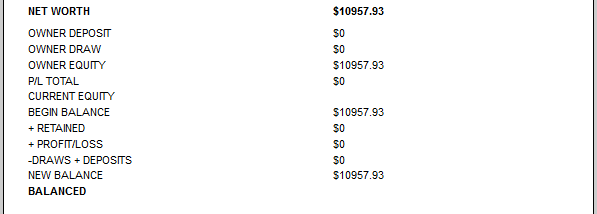

This article deals with finding errors in your accounting section that can affect your balance sheet. The first step is to insure that your balance sheet is balanced when you firs opened your books. To do this run a balance sheet for the first day on which you have records in your Income & Expense section. If you followed the instructions in the Setup Accounting section your first day should just contain the open account entries and the Equity adjustment to balance your Balance Sheet. This should be at the point where you have finished setting up your accounts and before you start entering any income or expenses. If this balance sheet does not balance the difference is your starting balance. To enter this you need to make an entry for OWNER EQUITY and enter whatever amount positive or negative that you are off. You will then get the word BALANCED at the end of the Balance Sheet report. See example:

FINDING DISCREPANCIES

The method for finding discrepancies is fairly straight forward. For our example lets assume it is now Dec. 31, 2014 and you started your business on Jan 1, 2014. Regardless of the time period involved in your balance sheet you will follow this same basic procedure.

So you run a balance sheet for 12/31/14 and it shows that you are out of balance. Next run a balance sheet thru 6/30/14 and see what that shows. It may show the same or a different balance off, or it may show that it is now balanced. If it shows balanced then the problem entry is after 6/30, if it shows that it is off there is a problem prior to 6/30. Let's assume that it is still off on 6/30. Split the difference and run a report for 3/31. Again, if it is off there is a problem prior to 3/31, if it is balanced, the problem is between 3/31 and 6/30.

Continue narrowing the date range until you have it down to the day it occurred. It will tell you how much it is off on that date. Exit the report go to FIND/DATE and enter the date of the reported error. Now toggle through the entries and look for the amount you're off, remember this may be a single entry or could be a combination of entries. Also look for 1/2 of the amount you are off and twice the amount you are off. The error could be in the Balance Sheet error on in a P&L error as both amounts affect the balance, so concentrate of finding the entry or entries that add up to the amount you are off. Once you know what entry it is you can correct the entry. If you are not sure how to correct the entry submit a TSR (Technical Support Request) and be sure to tell use the date, the amount you are off and the entry or entries that you believe are incorrect.

We can also do this work for you if you feel that would be better, but there is a charge for doing the basic work. If you know what entry is causing the problem, support is free, if you want us to find and correct the error then there is a $25/15 minute or portion thereof fee for the time it takes to do the work for you.