1099

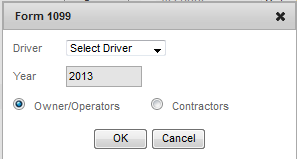

The 1099 is used for leased owner/operators and contractors who have hauled or done other work for you. For drivers (owner/operators) who are paid through payroll the program will separate 1099 pay from W2 pay based on the Medicare deduction which does not have a cap (maximum amount after which its no longer withheld. So you can have a driver who's W2 part of the year and 1099 part of the year. The selector will let you print 1099's for either Owner/Operators or Contractors.

Select the year, then the category you want to print and the program will print the popup box for you.

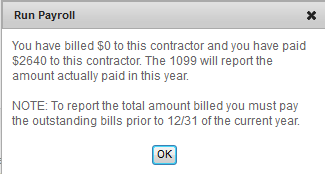

When you click OK you will be taken to the tax center. If you wish to do your own 1099's outside the program the information in the popup box is what you need from the program to do these on your own.

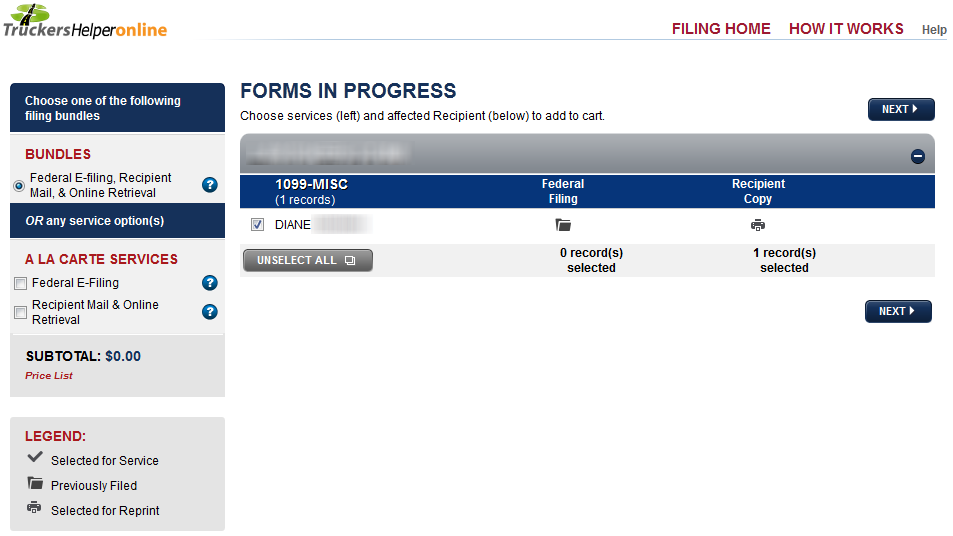

To file using the tax center simply select the service you want to use and click Next.